WTI Crude Oil et BRENT

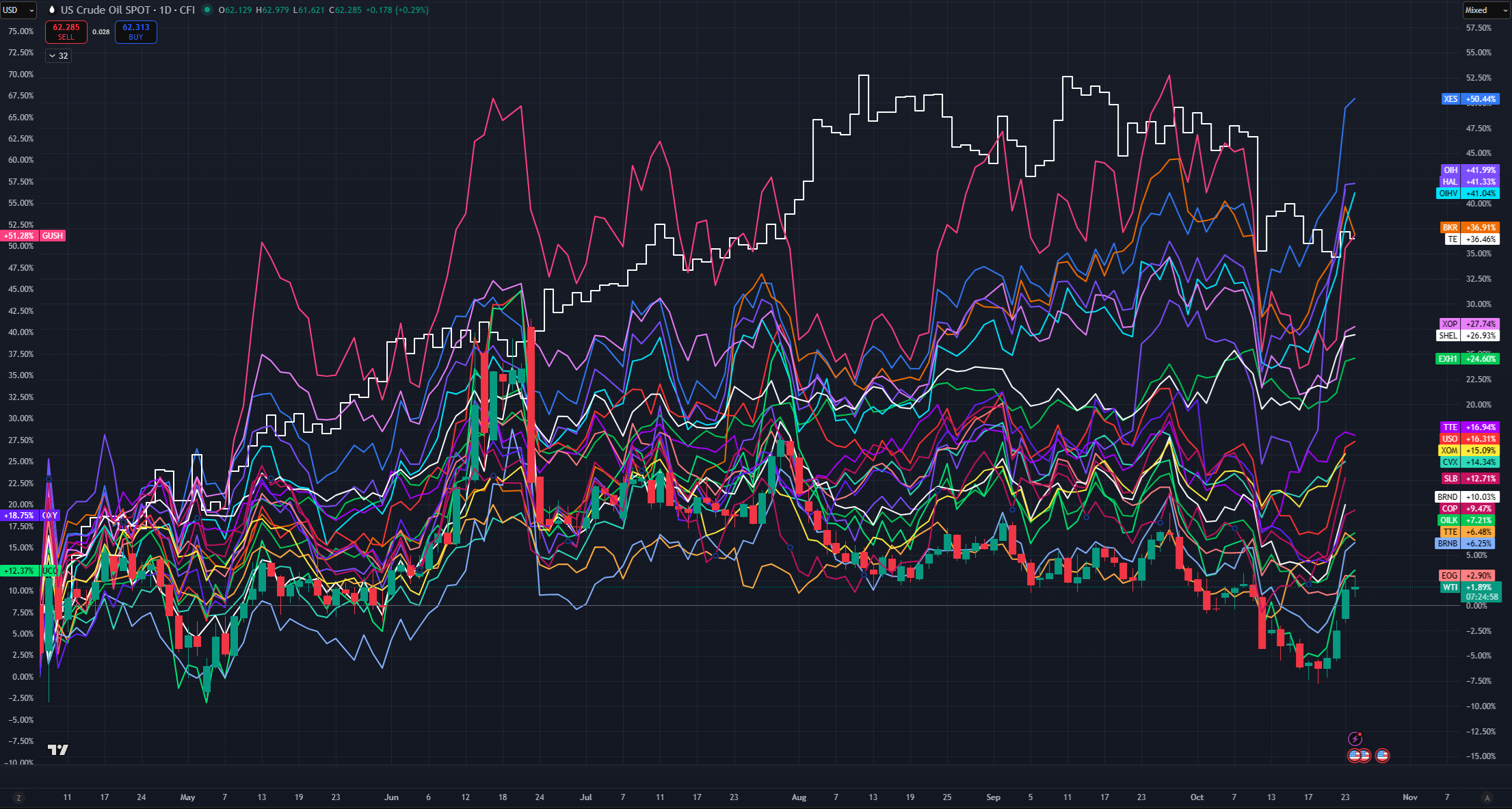

Des mouvements suite à l’annonce de Trump de sanctions sur ceux qui achetent du pétrole russe..

..mais sur le fonds rien de nouveau.. donc pur effet d’annonce, ca a surtout bougé au niveau des CFD et un peu sur les sous jacents et assets associés comme on le voit sur le graphe ci dessous :

Contexte

it looks unlikely at present that global demand for crude (for benchmarks like Brent crude oil or West Texas Intermediate crude oil) will consistently exceed production in the near term according to major forecasters. But there are lots of caveats. Here’s the breakdown:

🔍 What the data & forecasts say

-

According to the International Energy Agency (IEA): In 2025 global production is expected to outstrip demand. Their forecast shows supply rising by ~2.1 million barrels/day (b/d) in 2025, while demand growth is only ~0.7 million b/d. Investopedia+2Le Wall Street Journal+2 They expect the imbalance (supply > demand) to persist going into 2026. Financial Times+1

-

According to the U.S. Energy Information Administration (EIA): They forecast that global inventories will build (i.e. supply > demand) for 2025 and 2026. For example, they say global inventories are expected to increase through the forecast period. ogj.com

-

The EIA also notes demand growth is slowing (for example in the U.S. and China) while supply from non-OPEC / outside traditional producers remains robust. EIA États-Unis+1

-

Their price forecasts reflect this: they expect the average price of Brent to fall in 2026 compared to 2025 (because of the oversupply). ogj.com+1

📅 So when could demand exceed production?

Given these forecasts, here are some scenarios and timelines:

-

In the base case from major agencies: It seems not likely in the next few years (2025-2026) that demand will exceed production globally.

-

For demand to exceed production, you’d need one or more of the following to happen:

-

Demand growth accelerates significantly (e.g., strong economic growth in large-consuming countries, major increase in transport/industrial use)

-

Supply growth slows or production declines (e.g., due to large disruptions, steep cost rises, large policy shifts away from fossil fuel production)

-

Large unplanned outages or geopolitical disruptions that remove substantial supply from the market

-

-

If such conditions occur, you could get a supply-tight market and thus demand > supply (or “call on supply” exceeded).

-

But without those, the current consensus is supply will continue to outpace demand (thus inventories build) at least for the next couple of years.

-

A “demand > production” scenario might occur further into the future — for example if global supply capacity stagnates or declines, while demand remains or grows. But forecasting that reliably is very difficult.

✅ My projection & caveats

My estimate: If demand were to exceed production, it might happen mid-to-late next decade (e.g., 2030s) under a scenario of constrained supply + steady demand growth — but not imminently (i.e., not by 2026) based on current data.

Key caveats:

-

Forecasts can change quickly with new data (e.g., big policy shifts, climate regulation, new technologies, major supply disruptions).

-

“Production” is ambiguous: some forecasts refer to “production of crude & liquids”, some to “crude only”.

-

Regional mismatches matter: even if globally supply ≥ demand, some regions may face demand > local production (i.e., imports, tight regional markets).

-

Demand may plateau or decline in some regions (EV growth, efficiency, etc) which may reduce the chances of a global demand-exceeds-production scenario.

0 commentaires