Copie d’un bon article de Seeking Alpha

I Expect Novo Nordisk To Outperform Eli Lilly In 2026: Here’s Why

- Novo Nordisk A/S is rated a buy, driven by FDA approval of its oral Wegovy, strong fundamentals, and attractive valuation versus Eli Lilly.

- Recent clinical data and first-mover advantage position NVO’s oral semaglutide as potentially superior to Eli Lilly’s orforglipron, supporting market share recovery.

- Chinese patent extension and robust international presence provide additional growth levers, with oral Wegovy approval in China likely to offset minor revenue headwinds.

- NVO stock trades at a multi-year low P/E, maintains high profitability, a strong balance sheet, and consistent EPS growth, making it a compelling 2026 recovery candidate.

Victor Golmer/iStock Editorial via Getty Images

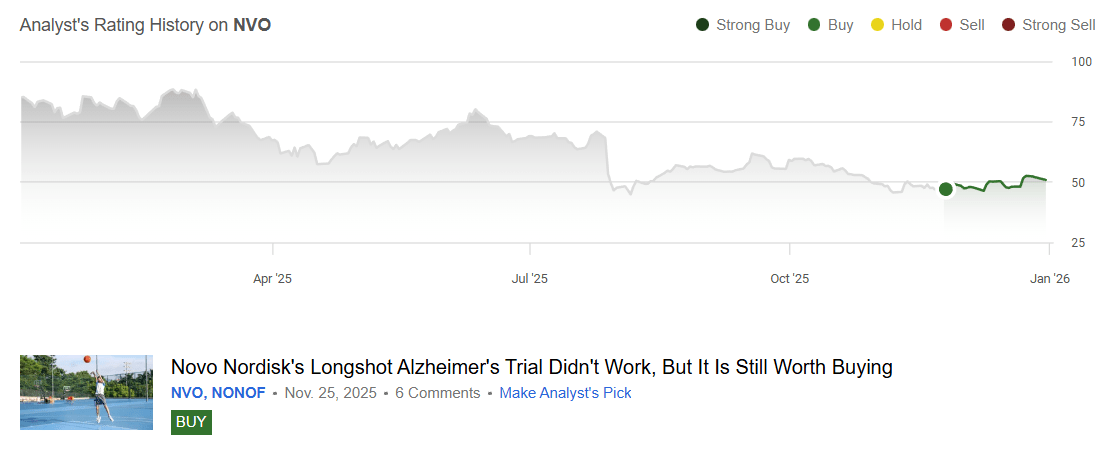

On November 25, my first coverage of Novo Nordisk A/S (NVO) was published on Seeking Alpha. Responding to recent news that its long-shot potential Alzheimer’s indication for Wegovy did not materialize as hoped, I nevertheless initiated coverage with a Buy rating. I considered the news more “noise” than a fundamental thesis breaker and believed in any case that after 18 months of negative sentiment endured by the company, the bottom was (finally) in.

Despite the seemingly interminable negative news of Eli Lilly (LLY) eating its lunch with their rival Zepbound/Mounjaro (tirzepatide) injections for weight loss and diabetes, at the time of my article, Novo Nordisk was still generating year-over-year revenue growth of 15% (on a constant currency basis). It was also trading at a multi-year low forward P/E ratio of 12.5 and offered a pleasing 4% dividend yield. I reasoned that buyers would soon outnumber sellers and send the stock higher. In my view, sentiment had been sour for so long, and a reconsideration (or recalculation) of the company’s still strong fundamentals was due soon. It was just a matter of time.

Seeking Alpha

With the positive news of the company’s weight-loss pill receiving FDA approval as a catalyst, shares have rebounded over 13% since my article. It remains to be seen whether I successfully called the bottom at under $46 a share and/or whether a year from now the stock will have outperformed the general market, which would justify the buy rating. As a shareholder myself, I averaged down with another small purchase at $46—putting my money where my mouth is, and timing my buy to perfection, it seems—so I feel entitled to feel at least a tiny bit of pleasure at the company’s stock performance since. But who cares about that? What investors want to know is:

- How sustainable is the company’s latest rebound? Does it signify a “dead-cat bounce” or a real and profound reversal?

In truth, this is a question that can only be answered with the benefit of hindsight, so perhaps a better question at this stage would be:

- What recent news propelled the stock upward, and what does this mean for the company’s prospects for 2026 and beyond?

In this regard, there are two major pieces of news worth reporting and discussing. I’ll go through them both before turning, briefly, to assess some financials and valuation metrics.

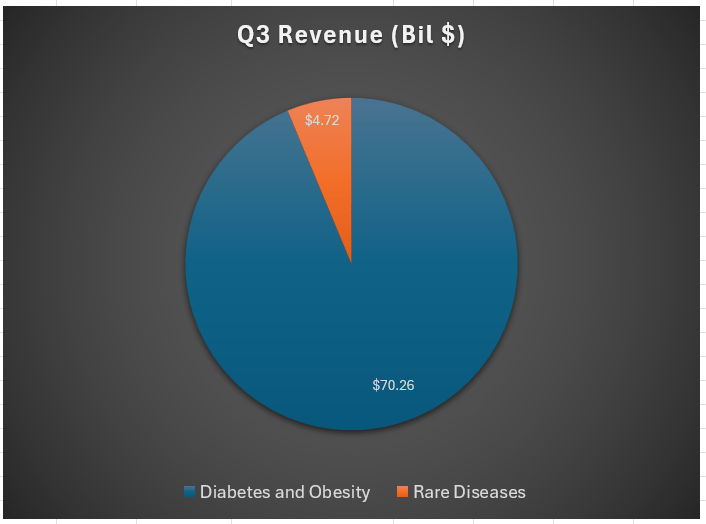

News on Its Oral Weight-Loss Pill

As a reminder to readers, the vast majority of Novo Nordisk’s revenue is derived from its diabetes and obesity care segments. This is where the company has increasingly focused its attention, moving away from the rare diseases segment that it used to have a stronger presence in.

Data from StockAnalysis

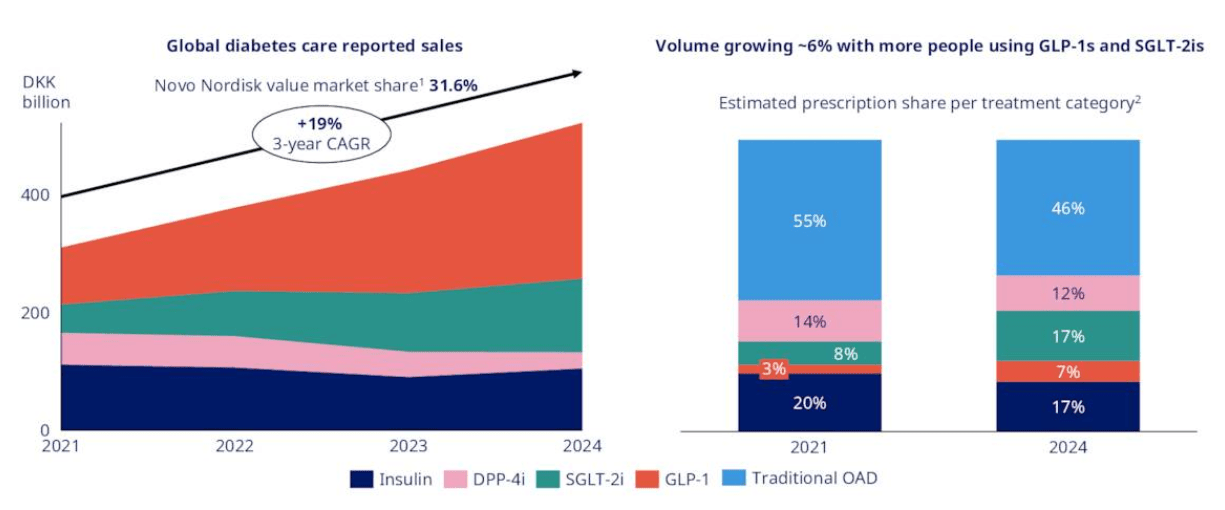

Novo Nordisk is part of a global duopoly in this segment, shared with Eli Lilly. They are the two leading companies with products in the GLP-1 market for both diabetes and obesity care, which has been the fastest-growing segment now representing the largest treatment focus for these areas.

Novo Nordisk Q3 2025 presentation

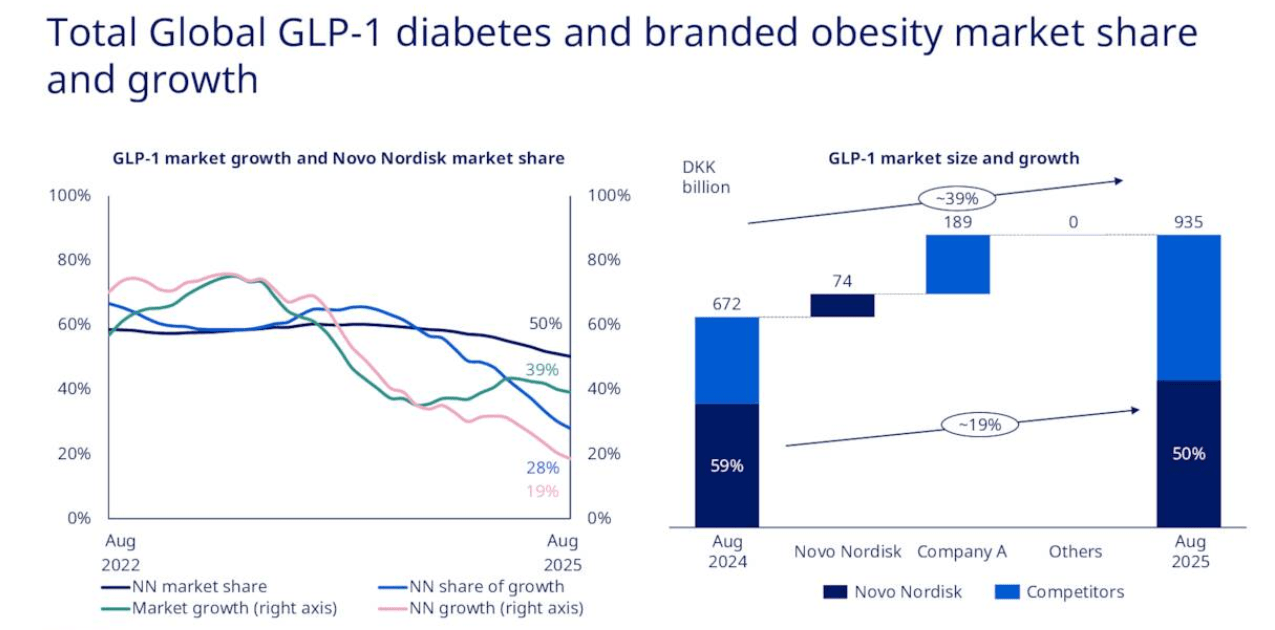

Over the past year or so, Novo Nordisk’s market share in this area has declined relative to Eli Lilly, a point that the company has not shied away from highlighting. This is a slide in their latest earnings presentation.

Novo Nordisk Q3 2025 earnings presentation

With a new CEO at the helm, they have made it their aim to shift this narrative and recover market share. Recent news regarding FDA approval for its oral version of Wegovy (semaglutide) will have helped in this regard. This is the first FDA-approved GLP-1 oral treatment for obesity. The results of their OASIS-4 trial showed 25 mg of oral semaglutide taken daily reduced weight by 16.6% on average for obese or overweight adults; « one in three people experienced 20% or greater weight loss, » according to management. While investors and patients alike are awaiting news of its actual launch—likely within the next few weeks—the company is anticipating a steady but pronounced switchover from injectable to oral semaglutide over the coming years, as patients opt for convenience. And why wouldn’t they? This positions Novo Nordisk, at least for the time being, ahead of its rival Eli Lilly, which is expecting FDA approval news on its own oral weight-loss drug by March, or possibly sooner.

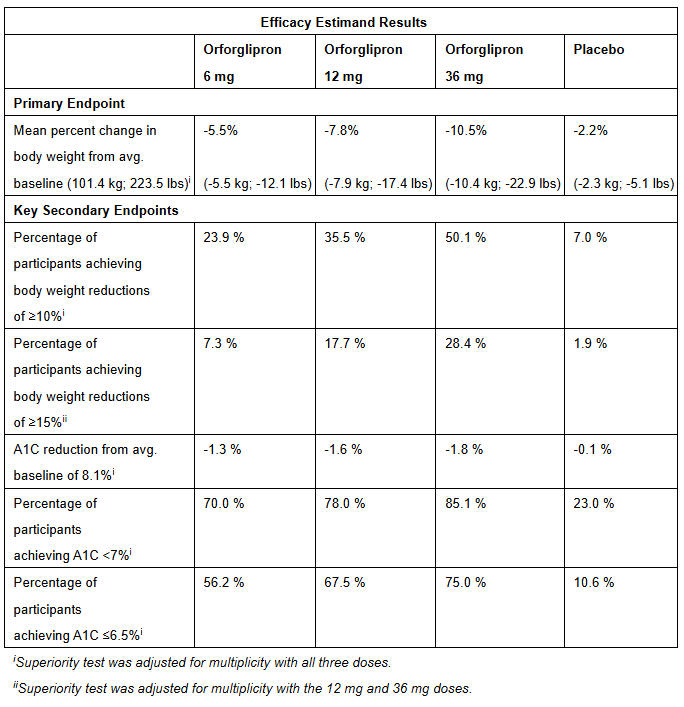

Eli Lilly’s phase 3 trial with results published in August, showed strong results for its own oral weight loss drug, with average weight loss from 36mg oral orforglipron of 10.5% compared to placebo (2.2%).

Eli Lilly

This is a positive result but suggests that orforglipron is inferior in efficacy to oral Wegovy. It should be noted that different trials have tended to yield slightly different results, so investors must assess a collection of studies rather than just one. More broadly, they should carefully consider whether Novo Nordisk being first to market will yield a long-term recovery in the company’s fortunes (and share price) or whether this development merely offers temporary respite from the Eli Lilly attack on its GLP-1 inhibitor market share.

In a head-to-head trial undertaken by Eli Lilly (published in September), which compared oral Wegovy (7mg and 14mg) with oral orforglipron (12mg and 36mg), the latter seemed to outperform in terms of controlling both blood sugar and weight loss. Oral semaglutide lowered A1C by 1.1% (at a 7 mg dose) and 1.4% (for 14 mg), while orforglipron lowered A1C by an average of 1.9% (at a 12 mg dose) and 2.2% (for 36 mg). Further, oral semaglutide showed weight loss of 3.8 kg (7 mg) and 5.2 kg (14 mg), but with orforglipron slightly better at 6.2 kg (12 mg) and 8.1 kg (36 mg).

On the surface—and contradicting the placebo-controlled trials measuring each drug individually—these results suggest that orforglipron is superior in the two most important metrics (weight loss and blood sugar control). However—and this is important—these results obscure the fact that the doses of oral semaglutide that Eli Lilly chose for this comparative trial (both 7 mg and 14 mg) were significantly lower in comparison to the 25 mg dose Novo Nordisk used when Novo Nordisk studied the drug for OASIS-4. If Eli Lilly had trialed a 25 mg dose, I am fairly certain the results would show superiority for oral Wegovy. My own level of certainty stems from two sources.

The first is a different study, with results published in The Lancet, whereby oral Wegovy was trialed, comparing 14 mg, 25 mg, and 50 mg doses, with improved glycated hemoglobin levels in the higher doses. While the trial did not assess weight loss, a higher HbA count is generally associated with higher body weight (specifically BMI) in type 2 diabetes patients.

The second is based on two earlier trials of orforglipron. The Phase 3 ATTAIN-1 trial showed a 12.2% average weight loss (with a 36 mg dose), while the Phase 3 ATTAIN-2 trial (cited above) showed 10.5% weight loss (with a 36 mg dose). Both of these underperform the 16.6% weight loss noted above for oral Wegovy at its optimal (or near optimal) dose of 25 mg.

I’d also like to speculate—or rather pontificate—on something else with regard to Eli Lilly’s comparative trial results published in September. To me, it is odd that Eli Lilly did not choose a higher dose of oral Wegovy for comparison, given that earlier Novo Nordisk trials (since this one from 2023) used 25 mg and 50 mg dosing protocols. Instead, Eli Lilly chose to follow « approved label instructions, » but to me this seems like a cop-out. Should Eli Lilly investors who are counting on the commercial success of oral orforglipron be concerned? To my mind, yes. The trial results make for what philosophers call a “straw-man argument” of the drug’s supposed superiority over oral Wegovy. Indeed, if the drug is better than its chief rival, and management feels confident that the drug is better, then why not trial it against Wegovy’s best dose? In my view, only if management is anticipating it (perhaps privately) to be inferior would they choose to trial it (publicly) in comparison against a weaker dose of its rival.

To use a sporting analogy, if England’s football team, in preparation for the upcoming World Cup, is truly trying to assess their standard against, say, Spain, Germany, or Brazil, then the very best England team should play the very best team from Spain, Germany, or Brazil, not their reserve or U21 team. In this study, Eli Lilly effectively trialed their very best team against Novo Nordisk’s reserves and beat them, but what does that really show aside from, perhaps inadvertently, their lack of confidence against Novo Nordisk’s very best team? It makes me wonder what Eli Lilly knows or what they are worried about. Their earlier ATTAIN 1 & 2 results would suffice to suggest their product is inferior, which leads me to believe their lead in this market is about to become more precarious. In any case, I’d appreciate hearing from other investors on this largely philosophical point.

As far as I am aware, a head-to-head trial comparing each company’s own determined optimal doses for both oral weight-loss drugs has not yet been undertaken either independently or by either company. Investors and patients alike, undoubtedly, would very much welcome such a trial being done to determine which drug offers the greatest efficacy along with a strong safety profile.

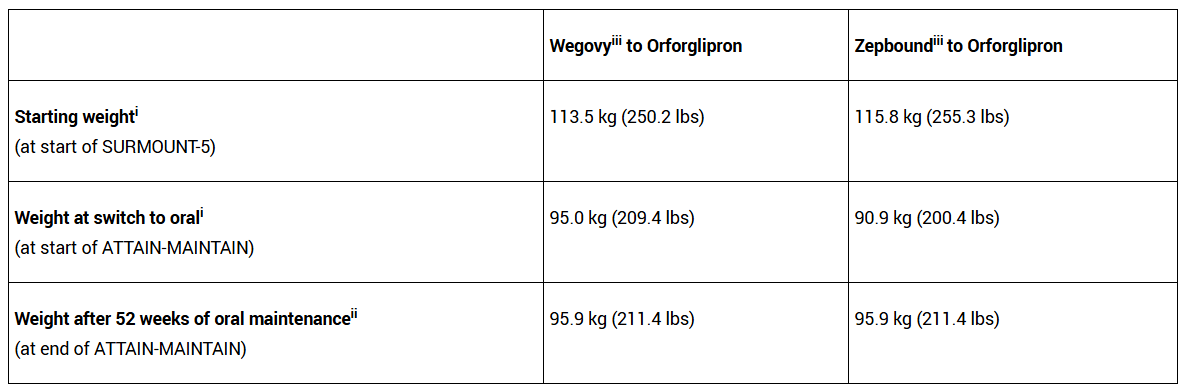

To compound the potential problem for Eli Lilly, results from a more recent trial (called ATTAIN-MAINTAIN), from 2 weeks ago, painted a positive picture for Novo Nordisk but a comparatively bleaker picture for Eli Lilly. The trial assessed the impact of patients switching to oral orforglipron from either injectable Wegovy or Zepbound, and showed that patients switching over from the latter did not maintain their weight loss as well as those switching from Wegovy. The trial participants switching from Wegovy to orforgliprom gained back just 0.9 kg of weight after 52 weeks, but those who switched from Zepbound gained back 5 kg—approximately 20% of the weight they had originally lost.

Eli Lilly

This would suggest that orforglipron is somewhat inferior to Zepbound for weight loss. This is a problem given that orforglipron is the company’s most advanced oral weight-loss pill, and that a huge proportion of their TAM for oral orforglipron will be patients already on (injectable) Zepbound. If patients know they’ll gain weight, this may hurt future revenues, especially when Novo Nordisk’s oral version (offering 16.6% weight loss) actually shows superiority to its injectable version in some trials (15.2% weight loss according to this STEP 5 trial from 2022). This is something that Eli Lilly cannot boast, by the looks of it.

To compound the problem still further, the ATTAIN-MAINTAIN trial showed that discontinuation rates due to adverse events for patients were higher for those switching from Zepbound to orforglipron (7.2%) than from Wegovy to orforglipron (4.8%).

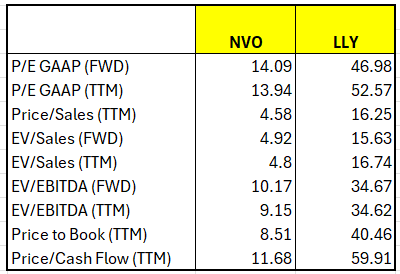

Taken together, these results were likely worse than Eli Lilly had hoped and will do little to satiate investors’ thirst for true comparisons as they contemplate future revenue growth/decline for the two drugs for 2026 and beyond. Eli Lilly is leading right now but also clearly trading at a premium across every valuation metric in comparison to Novo Nordisk and the industry in general. But will this continue given how the market will likely change following oral Wegovy’s approval in the US and, in time, abroad?

Data from Seeking Alpha

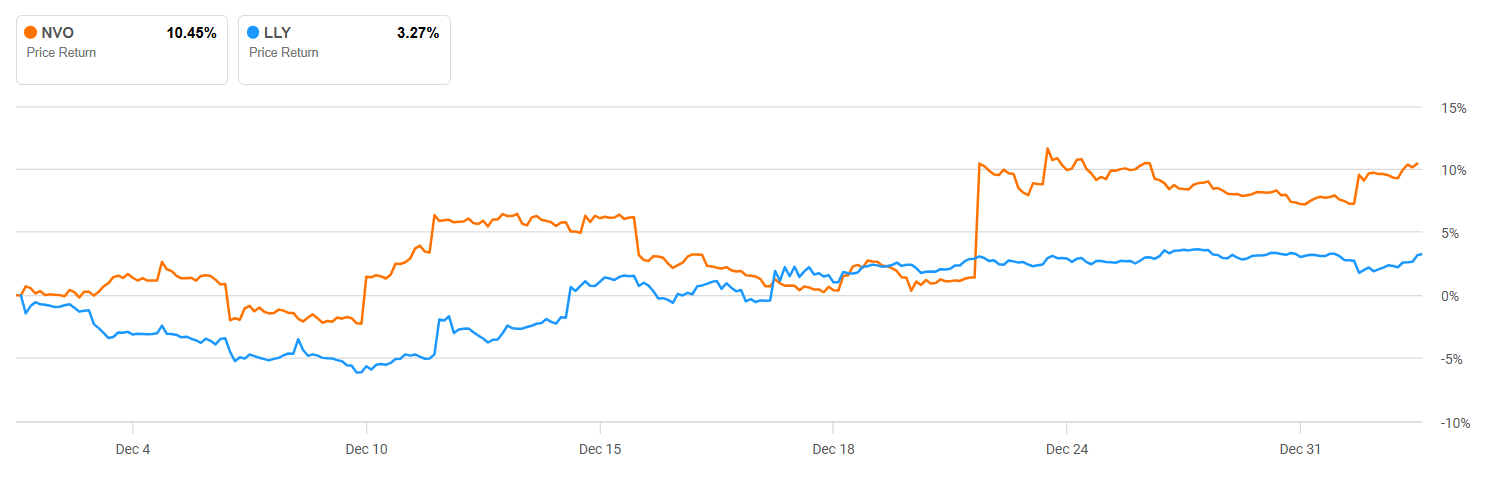

I would ask, is the recent (1-month) price action for both an indication of a future turnaround in this race? In my opinion, reading between the lines of their trial results, I believe it is. Novo Nordisk has a 1-month price performance of 10.51%, but Eli Lilly’s share price grew 3.3%.

Seeking Alpha

As a consequence of this, I would anticipate positive EPS and revenue revisions coming for Novo Nordisk, possibly at the expense of Eli Lilly. The latter has had a fantastic run over the last two years and is now priced to perfection. As such, while it might take several quarters before the full impact of this turnaround can be seen, I believe strongly that Novo Nordisk will have a stronger 2026 than its chief rival, Eli Lilly.

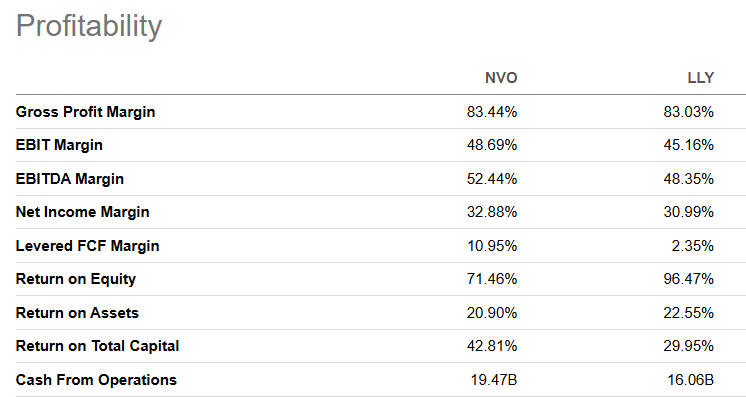

Fundamentally, it remains very profitable, superior to Eli Lilly in almost every profitability metric when using Seeking Alpha’s stats, though both get an A+ grade in this area.

Seeking Alpha

Regardless of what happens with Eli Lilly as an impact of Novo Nordisk’s incoming revenue ramp with its recently approved Wegovy pill, the latter is evidently en route for a turnaround. Other favorable news from China has also helped buoy the stock price.

News on China Business

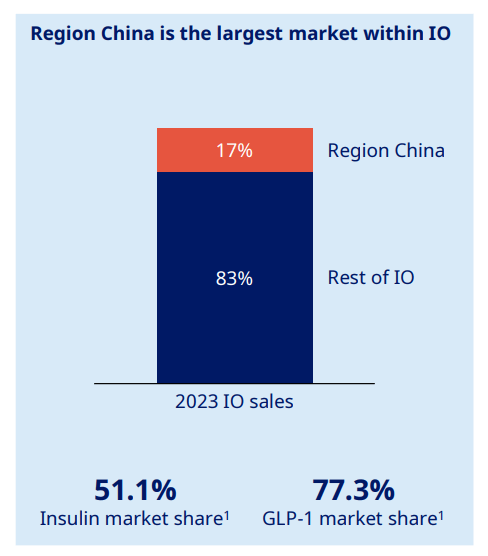

On December 31st, Seeking Alpha, among many other news outlets, announced a favorable ruling for its Ozempic/Wegovy patent in China—the Supreme People’s Court upheld its patent. While this is positive for the company, I do not expect the development to have more than a marginal impact on their revenue projections from the region, given that, firstly, TTM revenue from China of $19.2 billion represented just 6% of total TTM revenue of $315.8 billion, and about 14.2% of international TTM revenue of $134.8 billion, according to Q3 2025 results. Secondly, the patent was due to expire in March 2026 anyway. What the outcome signifies, to my understanding, is merely a several month extension of their product/sales dominance and renewed confidence in the company’s overseas market opportunities. This point was echoed by the Novo Nordisk President and CEO, Mike Doustdar:

“This decision also strengthens confidence for foreign companies’ sustainable development in China and will motivate further development and introduction of innovative medicines for the benefit of patients.”

The news comes off the back of their decision, announced on the 29th of December, to reduce its prices for injectable Wegovy across several Chinese provinces by up to 50%. Again, with the patent for injectable Wegovy in China expiring in March 2026, the news should have come as no surprise, as Novo Nordisk needed to reduce its prices so that they could stay competitive. It was also reported the following day that Eli Lilly followed suit, dropping its prices for Mounjaro for the start of 2026 because of the same intensifying competitive pressures.

Indeed, a Reuters report from 2024 suggested that 11 Chinese companies were in the development stage of creating generic equivalents of injectable Wegovy, all of which would be sold at much lower prices once approved. In September 2025, this figure was updated to 15 or 16 different companies, which includes CSPC Pharmaceutical Group (CSPCY, CHJTF), Hangzhou Jiuyuan Genetic Biopharmaceutical, United Laboratories (ULIHF), Jiangsu Hengrui Pharmaceuticals, Huadong Medicine, and Qilu Pharmaceutical. All of these have a generic semaglutide asset in the final clinical development phase.

Others are developing non-generic competitors to semaglutide. In February, China Daily reported that Innogen’s esupaglutide (another GLP-1 agonist) was approved in China to treat type 2 diabetes, and the company is currently trialing it for weight loss. In June, Seeking Alpha reported that Innovent Biologics (IVBIY, IVBXF) had received approval for its injectable weight-loss drug mazdutide, which it had originally licensed from Eli Lilly in 2019 for China, exclusively.

Several other companies in China are developing oral weight-loss drugs, potentially rivaling oral Wegovy and orforglipron. This includes Jiangsu Hengrui (candidate HRS-7535), Ascletis (candidate ASC30), Huadong (candidate HDM1002), and Vincentage (candidate VCT220), all of which showed promise in recent in-human trial results (linked above).

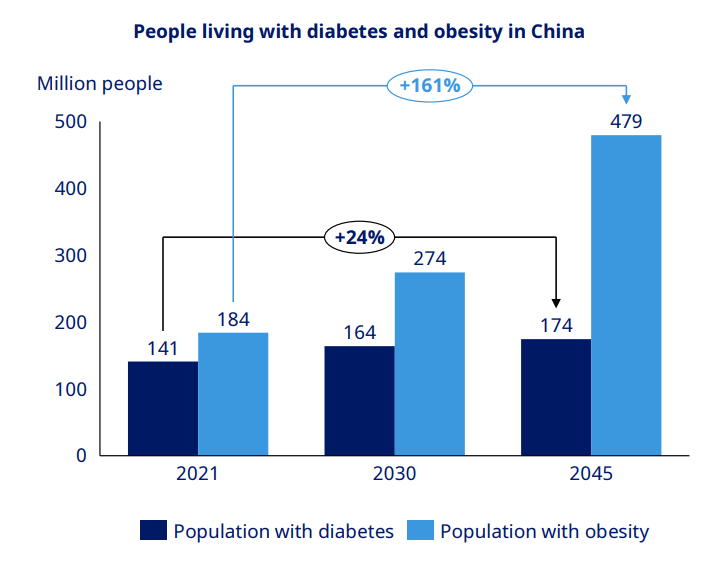

Evidently, the Chinese market for weight-loss drugs is massive and growing, with 148 million adults in China with diabetes. Also, estimates suggest potentially 65% of Chinese people could be overweight or obese by 2030. Thus, the market for weight loss drugs in China is estimated to grow to approximately $10 billion by 2033, according to a 2024 article from the Mercator Institute for China Studies.

Novo Nordisk suggests very strong growth in the TAM for China based on previous estimates.

Novo Nordisk Capital Markets Day 2024 presentation

They also estimate a near 80% market share in China for GLP-1 agonists.

Novo Nordisk Capital Markets Day 2024 presentation

In 2023, Novo Nordisk generated $16.69 billion in revenue from China, approximately $689 million from sales of Ozempic (to treat type 2 diabetes). Wegovy (for weight loss) was not approved until late 2024, but still generated $27.4 million in just two months of sales. Again, while this is very good, the likely reduction in revenue from China following their loss of patent protection is estimated to be ‘low single digits’ according to management. Given their revenue from China represented just 6% of their total revenue over the last four quarters, this seems like a very fair estimation in my view.

In general, a recent market report suggests that the GLP-1 market in China, looking forward, should be characterized by both ‘high potential’ and ‘high competition.’ I would agree with the sentiment, but I believe Novo Nordisk’s front-running position, driven by its leading market share with injectable Ozempic/Wegovy, will be strengthened if and when their oral version gets approved in China. This seems to be the plan for Novo Nordisk. After recent FDA approval, the company is looking forward to UK and EMA approval in the coming months. Regarding China, though the company—to my knowledge—has not specifically mentioned anything about an approval submission, it is very likely part of their global expansion plan. They are in a great position to seek approval in China, given they already have oral semaglutide diabetes data from published studies of both Chinese and East Asian populations. This would be necessary to support their applications. As such, I would be surprised not to hear about their plans to seek approval in China before the end of 2026, if not much sooner.

Such a development would likely help to offset the ‘low-single digit’ revenue drop they have anticipated, given their oral weight-loss drug is further advanced in the pipeline than their rivals. Even if Eli Lilly beats them to it in China—and there is no guarantee of that—oral Wegovy’s potential superior efficacy (as discussed above) and stronger market share in China for weight loss and diabetes may help them sustain their leadership there in years to come. That would be my expectation, though it could be another year or so before we see this outcome, and much may depend on their timing of their regulatory approvals in relation to Eli Lilly and Chinese competitors.

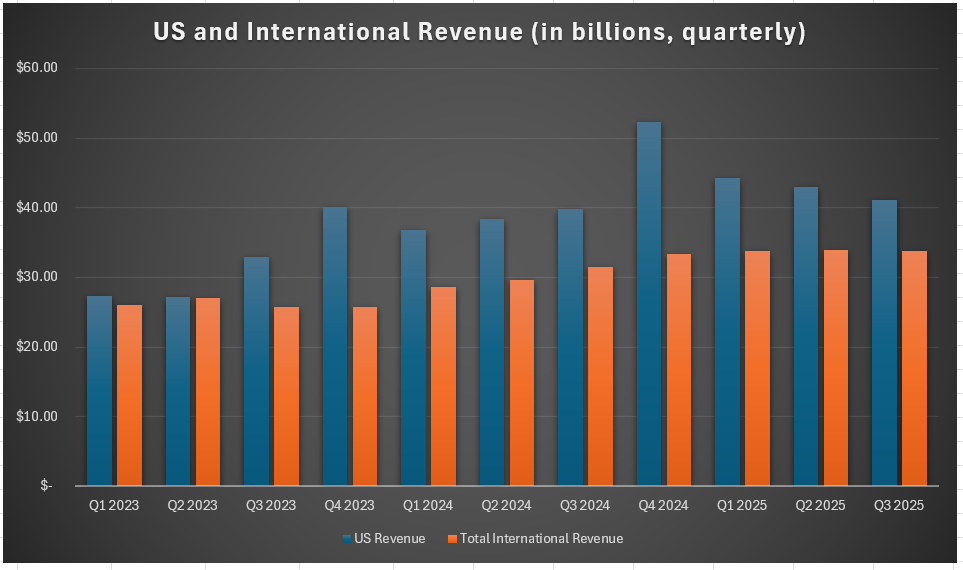

What it suggests in any case is that Novo Nordisk has a very strong international presence, which many investors in the U.S.—focused as they are on the American market, where they are losing market share to Eli Lilly—might overlook. Moreover, as I noted above, I expect them to reverse these market share losses with what I perceive to be a superior oral weight loss drug. That will be the start of their recovery in that region, while they have strength in other markets also to sustain them. Indeed, in Q3 alone, international revenue topped $33.8 billion, while US revenue was $41.1 billion. In previous quarters, ex-US revenue was nearly equal to U.S. revenue, and only in the past few years has this proportion shifted due to the market success of Ozempic and Wegovy.

Data from StockAnalysis

In general, the big picture is that this presents Novo Nordisk with strong growth potential in China and internationally, which, given their much cheaper valuation than Eli Lilly, positions them to not only recover in 2026 but also to outperform their rival as an investment. Let’s look at their financials now.

Financials and Valuation Metrics

Novo Nordisk has cash and equivalents of $32.58 billion, current assets worth $181.89 billion amidst total assets valued at $512.29 billion. They have a total debt of $101.21 billion, $12 billion of which is due to be paid back within the next 12 months. This is easily covered by their quarterly FCF ($32.48 in Q3 2025) and $66 billion over the TTM period. Their current debt/equity ratio is 0.6. I’d say they have a strong balance sheet, with a comfortable debt burden.

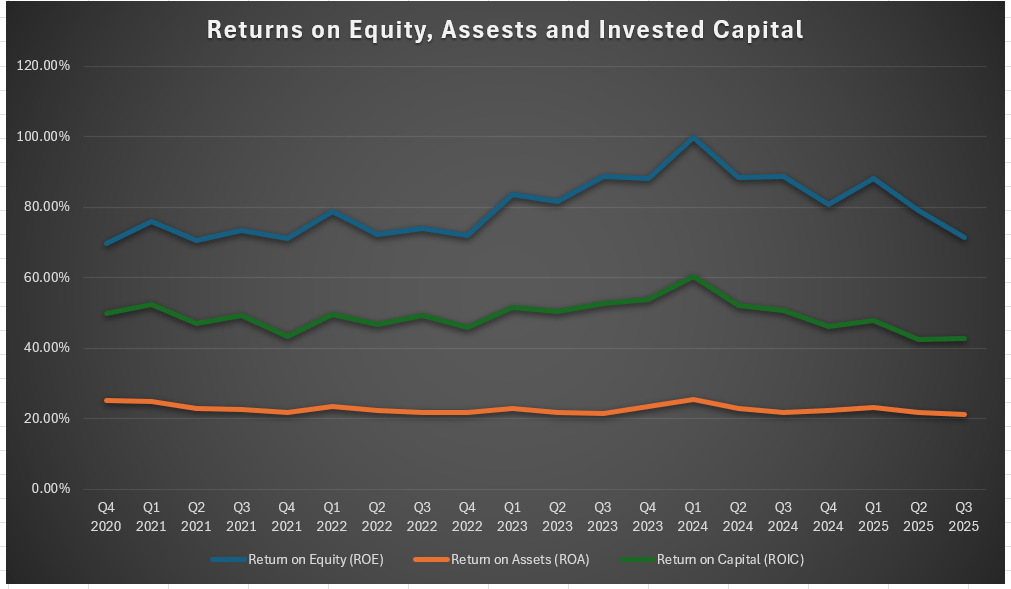

The company has rewarded shareholders not only with dividends but also with buybacks, and the total shareholder yield is 3.75%. They have consistently high returns on equity, assets, and invested capital, which are way above my own minimal thresholds for investment. Despite what the falling share price would imply in terms of a declining business, these measures suggest strength rather than weakness.

Data from StockAnalysis

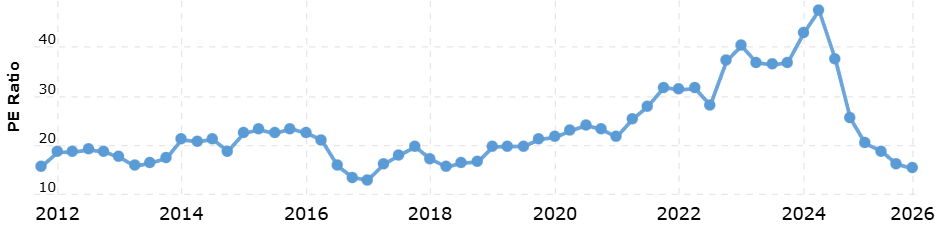

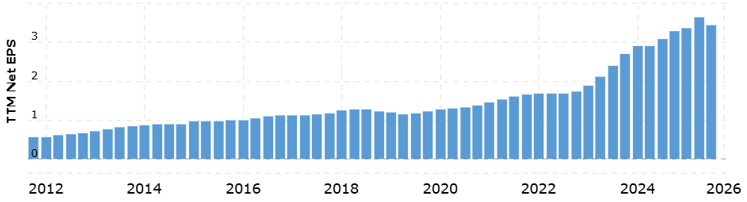

The stock is trading at its lowest P/E ratio in the last 7 or 8 years, and one of the lowest levels in its history.

MacroTrends

Is this a value trap? Given their consistent EPS growth, it seems unlikely.

MacroTrends

And given the likely market share gains from oral Wegovy, I would suggest Novo Nordisk is the opposite of a value trap. I consider it a bargain, a stock hit with declining sentiment but that is enjoying sustained growth, trading at a very compelling valuation. With Eli Lilly priced to perfection, Novo Nordisk seems the better option for 2026 returns right now. I continue to rate it a Buy, while I consider Eli Lilly a Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.