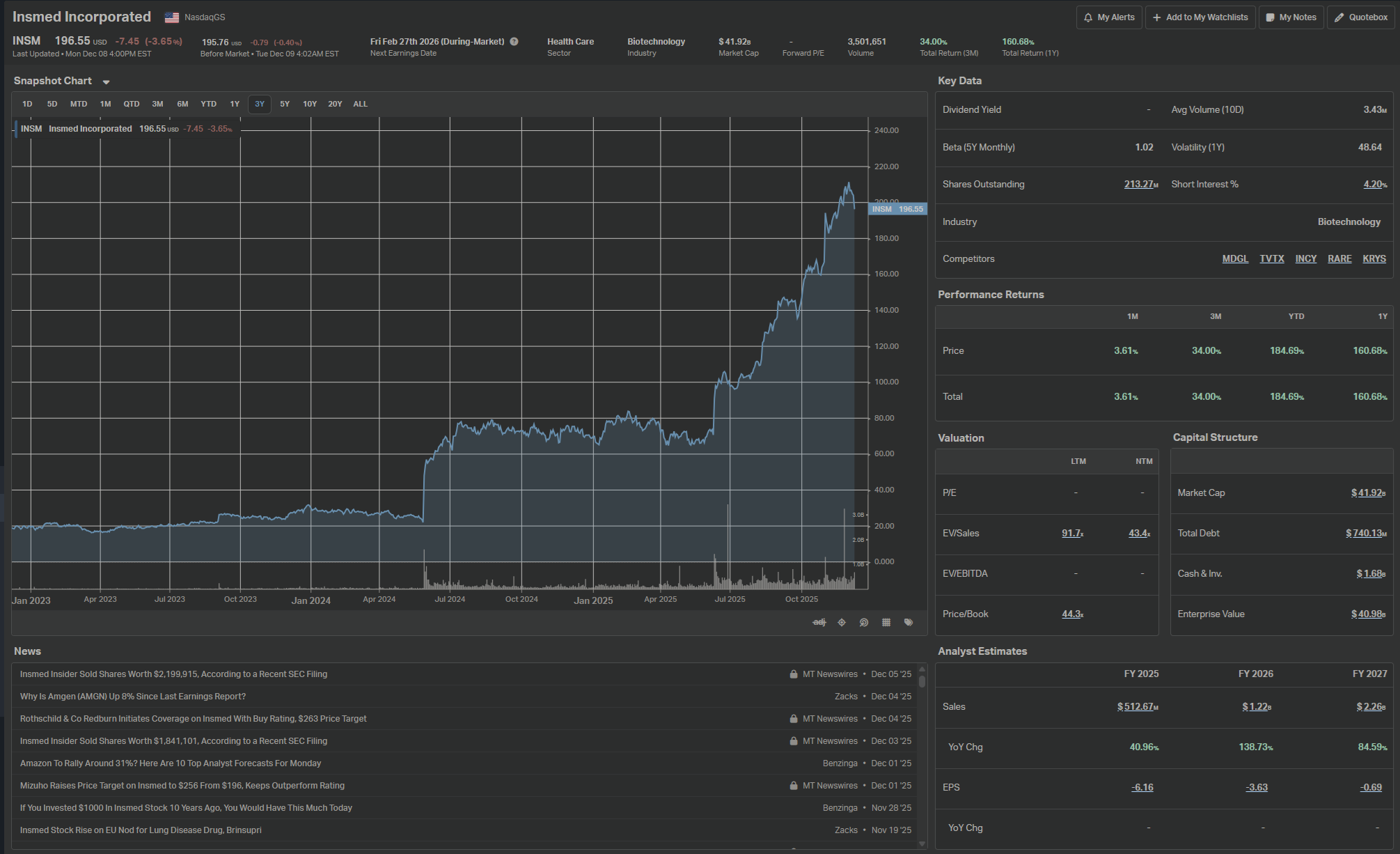

INSMED (NASDAQ: INSM) — Deep-Dive Investor Report, 24-Month Catalyst Timeline, 2030 Outlook & Price Scenarios

Insmed Incorporated (NASDAQ: INSM) is entering the most transformative period in its history. Once seen as a one-product company anchored by ARIKAYCE, Insmed is now positioned to become a multi-billion-dollar respiratory and rare-disease biotechnology leader. With Brensocatib nearing commercialization and multiple pipeline assets progressing toward late-stage milestones, the next 24 months will be pivotal.

This report delivers:

-

A fully developed 24-month catalyst calendar

-

A forward expectations model to 2030

-

Full risk analysis

-

Bull, Base, and Bear price scenarios

-

A WordPress-optimized, SEO-friendly structure

1. Company Snapshot

Ticker: INSM

Exchange: NASDAQ

Sector: Biotechnology / Rare Disease

Primary Revenue Driver: ARIKAYCE (NTM lung disease)

Major Pipeline Assets:

-

Brensocatib – DPP1 inhibitor for bronchiectasis

-

TPIP – Treprostinil palmitil inhalation powder for PAH / PH-ILD

-

Gene therapy & protein engineering programs (early-stage)

Investment Theme:

A high-growth, high-risk biotech transitioning from single-product to platform-driven respiratory leader.

2. Core Growth Drivers (2025–2030)

2.1 ARIKAYCE Expansion

Though ARIKAYCE is a mature product, it continues to generate stable revenue in refractory NTM patients. Earnings contribution acts as a foundation cash flow to support commercialization of future products.

2.2 Brensocatib — The Transformational Catalyst

Brensocatib is expected to become the first approved therapy for non-cystic fibrosis bronchiectasis, a disease with millions of patients and no current approved treatments.

Potential peak global sales estimates range from $2B–$5B depending on market penetration.

2.3 TPIP (Treprostinil Palmitil Inhalation Powder)

A next-generation inhaled prostacyclin therapy for pulmonary hypertension.

If successful, TPIP provides strategic diversification and leverages Insmed’s inhalation technology platform.

2.4 Global Expansion

A key long-term driver will be strong uptake in:

-

U.S.

-

Europe

-

Japan

-

Key emerging respiratory markets

3. 24-Month Catalyst Timeline (2025–2027)

This is the most important section for short-term investors and traders.

These events historically drive biotech valuation swings.

Q1–Q2 2025

-

FDA review updates for Brensocatib

-

EU & Japan regulatory filing progress

-

ARIKAYCE commercialization updates & guidance

-

TPIP Phase 3 program updates

Q3 2025

-

Possible FDA Advisory Committee meeting (if required)

-

Late-stage manufacturing readiness disclosures

-

Brensocatib real-world evidence publications

Q4 2025

-

FDA approval decision for Brensocatib (approximate window)

-

Pricing, reimbursement, and launch strategy announcement

-

Commercial sales force deployment reports

Q1 2026

-

Brensocatib U.S. launch

-

Initial prescription trends (first major stock-moving data point)

-

Early payer coverage updates

Mid-2026

-

EMA approval decision for Brensocatib

-

Japan PMDA regulatory milestone

-

TPIP late-stage trial readouts

Late 2026 – Early 2027

-

Brensocatib Europe rollout

-

Post-launch real-world clinical data

-

Updated peak sales guidance

-

Possible additional pipeline advancements

Market Sensitivity Note

Biotech stocks often move 30–80% in either direction around major readouts or approvals. INSM will not be an exception.

4. Expectations to 2030: Revenue, Profitability & Strategic Positioning

4.1 Revenue Trajectory (Conceptual Outlook)

| Year | Key Drivers | Growth Expectation |

|---|---|---|

| 2025 | ARIKAYCE + pre-launch prep | Stable to modest growth |

| 2026 | Brensocatib U.S. launch | Sharp revenue acceleration |

| 2027 | EU + Japan launches | Significant global uplift |

| 2028 | Brensocatib maturity curve | Approach multi-billion peak run rate |

| 2029–2030 | TPIP approval + label expansions | Diversification & margin expansion |

4.2 Profitability Outlook

Insmed is currently unprofitable, but if Brensocatib reaches scale:

-

Operating profitability may begin around 2028–2029

-

Gross margins could surpass 70% once manufacturing efficiencies stabilize

-

TPIP adds significant incremental margin leverage

4.3 2030 Strategic Identity

By 2030, Insmed is likely to be:

Scenario A (Bull):

A top-tier respiratory biopharma company generating $5B+ revenue, multiple marketed products, potential acquisition target.

Scenario B (Base):

A multi-product company with ~$2.5B–$3B in revenue driven primarily by Brensocatib.

Scenario C (Bear):

Still dependent on ARIKAYCE with limited adoption of Brensocatib or pipeline setbacks.

5. Price Scenarios (2025–2030)

Starting today (20251209) at 196 USD :

BULL CASE — $400–$650/share (2030)

Assumptions:

-

Brensocatib reaches $3B–$5B peak global sales

-

Strong uptake in U.S., Europe, Japan

-

TPIP approved for PAH & PH-ILD

-

ARIKAYCE label expansion successful

-

Margin expansion >30% long term

Narrative:

INSM becomes a top-tier respiratory company, potentially attracting Big Pharma acquisition interest.

BASE CASE — $180–$300/share (2030)

Assumptions:

-

Brensocatib achieves $1.5B–$2.3B peak sales

-

U.S. launch solid but not explosive

-

TPIP provides moderate contribution

-

ARIKAYCE steady growth

Narrative:

Insmed matures into a growing mid-cap biotech with dependable specialty-drug revenue.

BEAR CASE — $40–$80/share (2030)

Assumptions:

-

Brensocatib launch underwhelms or is delayed

-

Competitive entrants limit adoption

-

High expenses require repeated dilution

-

TPIP does not achieve approval

Narrative:

Company remains reliant on ARIKAYCE with unclear long-term path.

6. Risk Analysis

6.1 Regulatory Risk — VERY HIGH

Brensocatib’s approval process is the single largest risk.

Any delay can materially impact valuation.

6.2 Commercialization Risk

Respiratory markets require:

-

Deep physician education

-

Strong reimbursement

-

High patient persistence

Slow adoption can compress peak sales.

6.3 Competition Risk

Future DPP1 inhibitors or biologics may emerge.

6.4 Financial Risk

Insmed may require additional capital during launch phase → risk of dilution.

6.5 Pipeline Concentration Risk

Brensocatib accounts for the majority of valuation.

7. Investment Thesis Summary

Why investors are bullish:

-

First-in-class drug in a massive, underserved respiratory market

-

Potential multi-billion-dollar revenue runway

-

Globally scalable platform

-

Attractive acquisition profile in late-decade horizon

Why investors remain cautious:

-

High reliance on a single asset

-

Launch execution uncertainty

-

Future capital needs

8. Conclusion

Insmed (NASDAQ: INSM) is one of the most compelling late-stage biotech stories heading into 2025–2030. With the upcoming Brensocatib regulatory decisions and potential global commercialization, the company stands on the edge of a possible transformation into a leading respiratory-focused commercial powerhouse.

For investors seeking high-growth biotech exposure, INSM represents a high-risk, high-reward opportunity where the next 24 months will shape the next decade.

more with the PDF report :

20251209_INSMED

Overview

Overview