Chasing Unusual Options Activity

no free plan for that : The reality is that real-time, comprehensive UOA data is expensive to aggregate, which is why most quality sources charge for it. The free options give you glimpses, but not the full picture.

SwaggyStocks is probably the best bet for a truly free, no-strings-attached UOA scanner that you can check daily. It’s not as robust as premium services, but it’s legitimately free and functional.

TradingView doesn’t have robust built-in UOA tools, but you can:

1. Use TradingView for Charting + External Scanner

Find UOA on external tool (like SwaggyStocks)

Pull up the underlying ticker on TradingView

Analyze the chart for confirmation

This is honestly how most traders use it

Unusual Whales give some free signals on FB to bait new custs.

Plans from 25 to 99 USD/month :

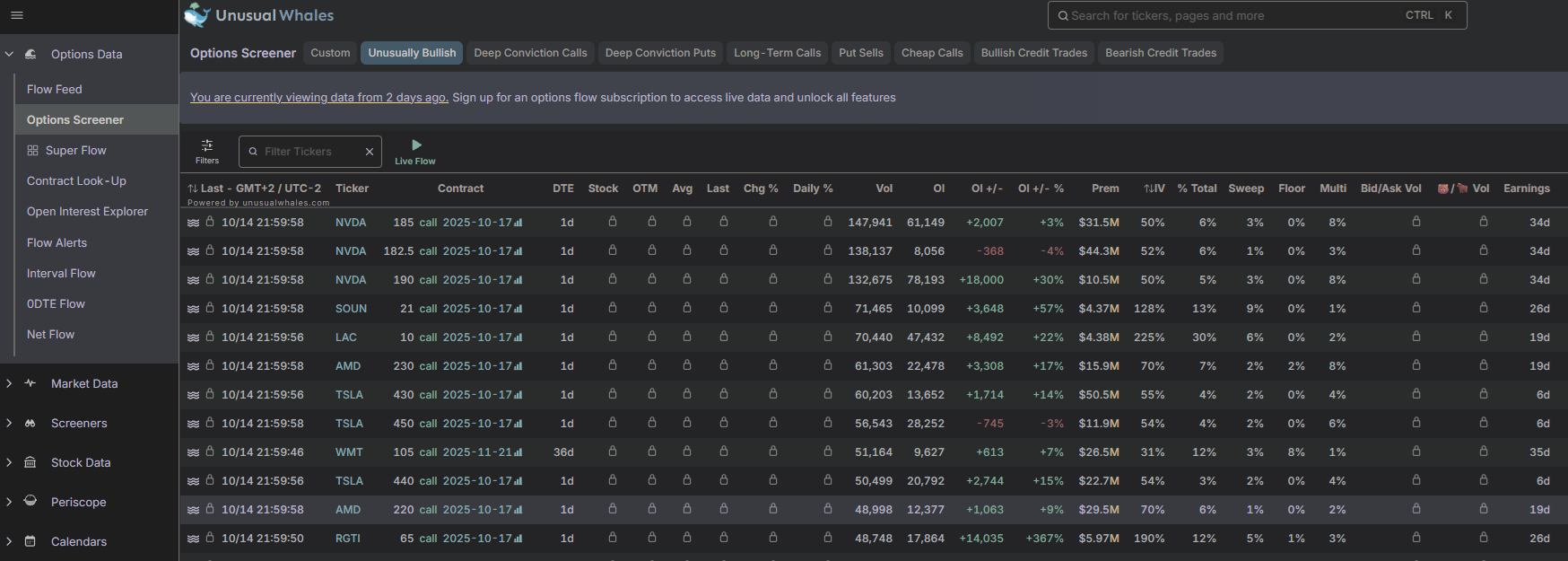

https://unusualwhales.com/options-screener

https://www.youtube.com/watch?v=eqiGixM6i5o

https://marketchameleon.com/Reports/UnusualOptionVolumeReport

https://www.barchart.com/options/unusual-activity/stocks

https://optionstrat.com/features

https://blackboxstocks.com/features/

Analysing UOA : let’s break down how to tell if unusual options activity is a directional bet (predicting movement) vs hedging (protecting existing positions).

Key Differences at a Glance

| Directional Bet | Hedging |

|---|---|

| Predicting price movement | Protecting against loss |

| Wants options to profit | Hopes options expire worthless |

| Typically aggressive execution | Often passive execution |

| Aligns with desired direction | OPPOSITE of actual position |

How to Identify HEDGING Activity

1. Put Buying on Strong Uptrends

Classic hedge signal:

- Stock has been rallying strongly (10-20%+ move)

- Sudden large put volume appears

- Puts are ATM or slightly OTM

- Low urgency (executed at MID or BID, not ASK)

What it means: Long shareholders protecting gains, NOT betting on a crash

Example:

- NVDA rallies from $120 → $145 in 2 weeks

- Large $140 put volume appears

- Interpretation: Likely hedge, not bearish bet

2. OTM Puts with Long Expiration

Protective put characteristics:

- 3-6+ months until expiration

- Strikes 5-15% below current price

- Modest premium relative to notional value

- Volume spreads across multiple strikes

What it means: Portfolio insurance, not directional speculation

3. Collar Strategies

Look for simultaneous activity:

- Buying puts (downside protection)

- Selling calls (financing the puts)

- Both executed together

Red flag for hedging: When you see both puts AND calls with unusual volume

4. Institutional Hedging Patterns

- Round lot sizes (100, 500, 1000+ contracts)

- Executed during regular hours (not pre/post market)

- Clustered around major support/resistance levels

- Correlates with 13-F filing positions

How to Identify DIRECTIONAL Bets

1. Aggressive Execution = High Conviction

Bullish directional signals:

- Calls bought at ASK price (paying up)

- Large sweeps across multiple exchanges

- Immediate execution (not limit orders waiting)

- Rising implied volatility on calls

Bearish directional signals:

- Puts bought at ASK price

- Aggressive sweep orders

- Increasing put IV while call IV stable/falling

Why this matters: Hedgers are patient (they’re insuring, not speculating). Directional traders pay up to get in NOW.

2. Near-Term Expiration (High Urgency)

Directional bet characteristics:

- 0-3 weeks until expiration

- Concentration in 1-2 strikes (not spread out)

- ATM or slightly OTM (not deep OTM lottery tickets)

Logic: Hedgers buy time (3-6 months). Speculators want quick moves (days/weeks).

3. Flow Aligns with Technicals

Strong directional signal when UOA confirms chart:

Bullish example:

- Stock breaking out of resistance

- Large call sweeps hit

- Volume increasing on underlying

- = Directional bet on continuation

Bearish example:

- Stock breaking key support

- Large put buying at ASK

- Underlying showing distribution

- = Directional bet on decline

4. Single-Sided Flow (No Offsetting Trades)

Directional bet pattern:

- Only calls OR only puts (not both)

- No corresponding opposite position

- Concentrated premium in one direction

Hedge pattern:

- Both calls AND puts active (collars, spreads)

- Balanced premium flow

Advanced: The « Greek » Tell

Delta Reveals Intent

Hedging typically uses:

- Lower delta options (0.30-0.50 delta)

- Further OTM strikes

- Less capital efficient (cheaper insurance)

Directional bets use:

- Higher delta options (0.50-0.70+ delta)

- ATM or near-the-money

- More capital efficient (maximize gains)

Vega Exposure

Directional traders often:

- Buy options BEFORE catalysts (earnings, FDA, etc.)

- Betting on IV expansion (vega positive)

- Want volatility to increase

Hedgers typically:

- Buy options AFTER volatility spikes

- Less concerned with IV changes

- Just want protection

Real-World Example Breakdown

Scenario: AAPL Unusual Put Activity

Data:

- AAPL trading at $185

- 50,000 contracts of $180 puts (30 DTE)

- Executed over 2 hours

- Stock up 3% on the week

Analysis Questions:

1. Is the stock trending?

- ✅ Yes, uptrend (+3% week)

- Leans toward: Hedge

2. How was it executed?

- If at ASK aggressively → Directional (bearish)

- If at MID/BID patiently → Hedge

3. What’s the expiration?

- 30 DTE = Medium term

- Could be either (need more data)

4. Strike placement?

- $180 puts = ~2.7% OTM

- Leans toward: Hedge (not ATM)

5. Any call activity?

- If also unusual call selling → Collar (hedge)

- If no call activity → Could be directional

6. IV behavior?

- If put IV spiking → Directional fear

- If put IV normal → Routine hedge

Likely conclusion: Given uptrend + OTM strikes + size, probably institutional hedge protecting long stock positions.

Quick Decision Framework

Ask These 5 Questions:

1. What’s the stock’s recent trend?

- UOA opposite trend = likely hedge

- UOA with trend = likely directional

2. How aggressive was execution?

- ASK = directional

- MID/BID = hedge

3. What’s the time frame?

- <30 days = directional

-

60 days = hedge

4. Is there a catalyst coming?

- Yes (earnings, FDA) = directional

- No catalyst = hedge

5. Single-sided or balanced?

- Only calls/puts = directional

- Both = hedge/spread

Highest Probability Directional Signals

Look for ALL of these together:

✅ Sweeps/blocks at ASK

✅ Short-dated (1-4 weeks)

✅ ATM or 1 strike OTM

✅ Single direction (calls OR puts, not both)

✅ Aligns with chart setup

✅ Near catalyst (earnings, news)

✅ Rising IV in that direction

✅ Premium > $1M+

When you see 6+ of these = HIGH conviction directional bet

Highest Probability Hedging Signals

Look for these patterns:

✅ Stock in strong trend, opposite UOA appears

✅ Executed at MID or BID (patient)

✅ Long-dated (60+ days)

✅ Multiple strikes (spread out)

✅ Both calls AND puts active

✅ Round institutional lot sizes

✅ No immediate catalyst

When you see 5+ of these = Likely hedge, NOT directional

Pro Tips

1. Check the Put/Call Ratio

- Extreme readings (>2.0 or <0.5) often signal hedging exhaustion

- Normal readings with spikes = directional

2. Look at Dark Pool Activity

- Large block stock purchases + call buying = bullish

- Large block stock purchases + put buying = hedging those shares

3. Follow-Through Matters

- Directional bets: Activity continues over multiple days

- Hedges: One-time positioning, then quiet

4. Use OpenInterest Changes

- OI increasing + volume = NEW positions (directional)

- OI flat + volume = Day trading/closing (less reliable)

The Ultimate Test

After spotting UOA, wait 1-2 days and ask:

- Did the stock move in the direction of the options?

- YES → Likely directional bet

- NO → Likely hedge or wrong bet

- Did similar activity continue?

- YES → Directional campaign

- NO → One-time hedge

Bottom Line

Hedging = Insurance (hopes it expires worthless)

- Long-dated, OTM, opposite of trend, patient execution

Directional = Speculation (wants to profit)

- Short-dated, ATM, aggressive execution, aligns with setup

The key: Hedging activity is actually contrarian indicator (bullish position needs bearish hedge). Directional activity is a confirmation signal (betting with conviction).

Now let’s analyze real recent examples to practice identifying hedge vs directional bets.

Example 1: SANA Biotechnology (SANA) – October 17, 2025

The Data:

SANA saw 22,284 call contracts traded (38x average daily volume and 12x the put volume). Most activity was in same-day expiration (October 17th) with the $5.00 and $7.50 strikes trading over 15,000 contracts collectively. Trading was two-way: traders bought $5.00 strike calls and sold $7.50 calls. Stock closed at $5.72, up $1.27.

Our Analysis:

Question 1: What’s the stock trend?

- ✅ Strong upward move (+28% that day based on $1.27 gain to $5.72)

- Signal: Momentum trade

Question 2: Execution style?

- Two-way trading (buying AND selling)

- This is a spread, not pure directional

Question 3: Time frame?

- Same-day expiration (0 DTE)

- Ultra-short term = speculation/day trading

Question 4: Strike placement?

- $5.00 calls = slightly ITM

- $7.50 calls = 30% OTM

- Pattern: Bull call spread

Question 5: Catalyst?

- Stock up 28% – likely news-driven

- Activity AFTER the move

VERDICT: 🎯 DIRECTIONAL BET (Bullish)

Why: This is a bull call spread (buy lower strike, sell higher strike). Traders are betting on continued upside but capping gains at $7.50. The 0 DTE timing suggests day traders/speculators riding momentum AFTER news broke. NOT a hedge – this is pure speculation on continuation.

Confidence: 85% directional

Example 2: Endeavor Silver Corp (EXK) – October 17, 2025

The Data:

EXK saw 12,004 put contracts (13x average daily put volume). Nearly all activity in November 21st expiration at the $7.50 strike. Traders bought the $7.50 puts over 11,000 times through large block trades at $0.40 (the ask price). Stock was at $9.24, up $0.54 that day. Open interest was already 8,589 contracts.

Our Analysis:

Question 1: What’s the stock trend?

- ✅ Stock UP 6.2% that day

- Put buying on an UP day = suspicious

Question 2: Execution style?

- Bought at ASK = aggressive

- Large block trades = institutional size

- Signal: High conviction

Question 3: Time frame?

- 35 days to expiration (Nov 21)

- Medium term = not day trading

Question 4: Strike placement?

- $7.50 strike with stock at $9.24

- That’s 18.8% OTM

- Moderate protection level

Question 5: Existing position?

- Open interest already 8,589 contracts

- Could be adding to existing hedge OR directional bet

Question 6: Single-sided?

- ✅ Only puts, no call activity mentioned

- Leans directional

VERDICT: ⚖️ 50/50 – COULD BE EITHER

Hedge scenario (45% probability):

- Stock rallying (+6.2%), institutions protecting gains

- 18.8% OTM = reasonable portfolio insurance level

- Large blocks = institutional characteristics

- November expiration = not urgent

Directional scenario (55% probability):

- Bought at ASK = paying up for speed

- Single-sided flow (no calls)

- Could be betting rally is exhausted

- Medium-term timeframe suggests conviction

This is the hardest type to call! I’d lean slightly toward directional bearish bet because:

- Execution at ASK (aggressive)

- Single direction

- No extreme OTM (not just insurance)

Follow-up to confirm: Watch if EXK drops in next 1-2 weeks. If yes = directional was right. If stock keeps rallying and puts expire worthless = was a hedge.

Example 3: Bank of America (BAC) – October 16, 2025

The Data:

16 bullish trades detected in BAC. Multiple analysts have Buy/Overweight ratings with price targets of $56-$62. Current price around $52.23.

Our Analysis:

Question 1: What’s the context?

- Multiple analyst upgrades

- Price targets 7-19% above current

- Bullish sentiment widespread

Question 2: Activity description?

- « Noticeably bullish stance »

- « Whales with money to spend »

- Suggests large institutional buying

Question 3: What’s missing?

- Strike prices not specified

- Expiration dates not mentioned

- Execution style unclear

Limited data, but making educated guess:

VERDICT: 🎯 LIKELY DIRECTIONAL (Bullish)

Why:

- Described as « bullish stance » not « hedging »

- Following analyst upgrades

- « Whales taking positions » language suggests new bets

- Timing with positive catalysts (earnings, upgrades)

Confidence: 70% directional (would need strike/expiration data to be certain)

Example 4: Procter & Gamble (PG) – October 15, 2025

The Data:

PG saw 8 trades with « noticeably bullish stance from whales. » Stock trading at $148.03, down 0.76%. RSI suggests stock may be oversold. Earnings in 9 days. Analysts have $167.20 consensus target (13% upside). Multiple Buy/Overweight ratings at $170-$174 targets.

Our Analysis:

Question 1: Stock trend?

- Down day (-0.76%)

- RSI oversold

- Below analyst targets

Question 2: Catalyst?

- ✅ EARNINGS IN 9 DAYS

- This is huge!

Question 3: Positioning?

- « Bullish stance »

- Before major catalyst

VERDICT: 🎯 DIRECTIONAL BET (Bullish)

Why this is textbook directional:

- Pre-earnings positioning = classic directional play

- Buying calls when stock oversold = bottom fishing

- « Whales taking stance » before known catalyst

- 9 days to earnings = perfect timing for short-term options

- Analyst upgrades providing fundamental support

Confidence: 90% directional

This is almost certainly institutions positioning for a positive earnings surprise. The 9-day timeline is the dead giveaway.

Key Patterns Observed

Clear Directional Signals:

- ✅ SANA: 0 DTE momentum chasing with spreads

- ✅ PG: Pre-earnings positioning with catalyst coming

- ✅ BAC: Following analyst upgrades

Ambiguous (Need More Data):

- ⚖️ EXK: Aggressive execution but stock rallying (could be either)

What Did We Learn?

Easiest directional signals to spot:

- Catalyst proximity (earnings, FDA, etc.)

- 0-3 week expiration with aggressive execution

- « Bullish/bearish stance » language in reports

- Activity AFTER analyst upgrades/downgrades

Hardest to interpret:

- Put buying on up days (could be hedge or contrarian bet)

- When only volume reported without strike/expiration details

- Activity with existing high open interest

The golden rule: When in doubt, look for:

- Time to catalyst

- Execution aggressiveness (ASK vs BID)

- Single vs two-sided flow