🧩 The Best Investment/Research Platforms

for Long-Term Investors

If you’re a mid- or long-term investor focusing mainly on U.S. markets — and sometimes the E.U. — the right combination of tools can give you an edge.

With so many platforms out there, from free screeners to professional research dashboards, it’s hard to know which ones are worth your time and money.

In this guide, we’ll compare the best investment research tools you can use today — especially if you already have TradingView Premium and want to complete your setup for a 360° view of the markets.

LIST View

🏛️ Core Fundamentals & Research Tools

morningstar.com

Best for: Long-term investors, fund/ETF analysis

Price: Around €250–€300 / year

Why it’s great: Morningstar offers one of the most respected independent research databases in the world. You’ll get deep fundamentals, analyst ratings, and the famous Star and Medalist systems for mutual funds and ETFs.

Verdict: ⭐ Highly recommended – a cornerstone for any serious investor portfolio.

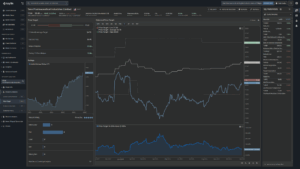

koyfin.com

Best for: Data-driven investors who love visuals and macro context

Price: Free tier + €250–€400 / year for Pro

Why it’s great: Koyfin provides interactive charts, macro dashboards, and company fundamentals. It’s like a “Bloomberg Lite” for private investors.

Verdict: ⭐⭐ Excellent value — a perfect complement to TradingView.

InvestingPro

Best for: Market overview, economic calendars, quick data lookups

Price: Free (ads) or €200–€300 / year (Pro)

Why it’s great: Covers global assets — stocks, indices, forex, crypto, bonds — with news and charts. Pro adds fundamentals and valuation ratios.

Verdict: ✅ Keep it as your macro dashboard.

🧮 Screening & Stock Discovery Tools

finviz.com

Best for: Quick U.S. equity filtering and heatmaps

Price: ~€300 / year

Why it’s great: Super-fast stock screener, ideal for filtering thousands of U.S. equities using valuation and performance metrics.

Verdict: ✅ Essential if you screen U.S. stocks regularly.

stockrover.com

Best for: In-depth U.S. fundamental screening

Price: €200–€400 / year

Why it’s great: Offers highly detailed filters and back-tested performance tools. Great for value or dividend investors.

Verdict: 👍 Alternative to Finviz if you prefer table-style data.

simplywall.st

Best for: Visual investors who want simple “health” summaries

Price: ~€150 / year

Why it’s great: Beautiful visuals (“snowflake” graphics) summarizing valuation, past performance, health, dividend, and growth.

Verdict: 👍 Great supplement for a quick read before investing.

📊 Sentiment & Ratings Platforms

www.tipranks.com

Best for: Checking analyst consensus and insider trades

Price: €200–€350 / year

Why it’s great: Aggregates analyst ratings and performance records, showing the consensus price targets and insider sentiment.

Verdict: 💬 Optional but useful sanity check.

marketbeat.com

Best for: Tracking analyst upgrades/downgrades and dividends

Price: Free (ads) or ~€150–€300 (premium)

Verdict: 🧭 Good free add-on — helps you stay aware of market sentiment.

www.zacks.com

Best for: Earnings-driven investors and stock ranking systems

Price: €250–€400 / year

Verdict: 💹 Optional — useful if you like trading around earnings or revisions.

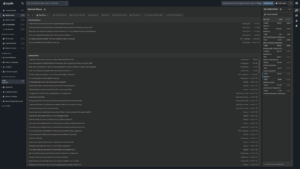

💡 Idea Generation & Research Libraries

seekingalpha.com

Best for: Reading bull/bear theses, quant scores, and earnings call recaps

Price: ~€250 / year

Why it’s great: Huge community of investors and analysts sharing detailed company write-ups and quant scores.

Verdict: ✅ Must-have for idea discovery and opposing viewpoints.

www.fool.com

Best for: Beginners and long-term growth-stock followers

Price: €100–€300 / year

Verdict: 🙂 Optional — good for idea flow, but not a data platform.

⚙️ Recommended Setup for You (U.S.-Focused, Long-Term)

| Category | Platform | Role | Why |

|---|---|---|---|

| Core Fundamentals | Morningstar Premium | Deep research & fund analysis | Anchor your analysis on trusted data |

| Macro / Data Analytics | Koyfin | Visuals + macro dashboard | Connect company data to macro trends |

| Screening | Finviz Elite | U.S. stock filtering | Quickly find undervalued or trending names |

| Charting | TradingView Premium | Technical analysis & alerts | Already covered — best in class |

| Ideas & Research | Seeking Alpha Premium | Community insights & quant ratings | Keeps your conviction tested |

| Global Overview | Investing.com (Free) | Calendars & news | Maintain broad market context |

💰 Estimated annual cost: ~€800–€1,000 / year

→ Comparable to semi-professional setups but tailored for an advanced retail investor.

💸 Want to Stay Lean (< €400 / Year)?

If you prefer a lighter setup:

-

Koyfin (Free or base Pro)

-

Finviz (Free)

-

Simply Wall St (~€150)

-

Investing.com (Free)

-

Seeking Alpha (Free)

This “lean stack” still covers fundamentals, screening, and macro context without big recurring costs.

🧭 Final Thoughts

Choosing the right mix of platforms isn’t about finding the one perfect tool — it’s about combining strengths:

-

Morningstar and Koyfin for fundamentals and macro context

-

Finviz or Stock Rover for screening

-

Seeking Alpha for research and perspective

-

TradingView for execution and timing

By layering these tools, you’ll have the same analytical coverage as many professionals — but at a fraction of the cost.

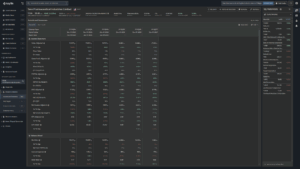

TABLE View

🏛️ 1. Core Fundamentals & Research

| Platform | Role | Why You Need It | Tier / Cost | My Take |

|---|---|---|---|---|

| Morningstar Premium | Deep fundamentals, analyst opinions, fund/ETF comparison | Excellent for long-term investors; best in class for fund/ETF research and portfolio “X-Ray.” | ~€250–€300 / yr | ✅ Highly recommended — core anchor for long-term analysis. |

| Koyfin | Data dashboard + macro + visual analysis | Complements TradingView with macro context, valuation charts, and multi-asset correlation. | Free to try, ~€250–€400 / yr for Pro | ✅ Excellent value for data-driven long-term investors. |

| Investing.com (free or Pro) | Global data + earnings/calendar | Great macro context, quick news and calendars (earnings, dividends, economic). | Free / €200 yr (Pro) | ✅ Keep as macro hub; free version is sufficient. |

🧮 2. Screening & Stock Discovery

| Platform | Strength | Cost | My Take |

|---|---|---|---|

| Finviz Elite | Super-fast filters, valuation ratios, insider activity, performance heatmaps. | ~€300 / yr | ✅ Ideal for U.S. equity screening — use it to narrow watchlists. |

| Stock Rover | Deep U.S. fundamental screener with back-tested metrics, portfolio tracking. | ~€250 / yr | 👍 Alternative to Finviz if you prefer table-based screeners. |

| Simply Wall St | Easy-to-digest visuals (“snowflake”) showing value, past performance, health, dividend, growth. | ~€150 / yr | 👍 Nice supplement for a quick visual read before investing. |

📊 3. Sentiment / Ratings Layer

| Platform | Use Case | My Take |

|---|---|---|

| TipRanks | See analysts’ consensus targets and top analysts’ success rates. | 👍 Optional add-on for validation of analyst sentiment. |

| MarketBeat | Track upgrades/downgrades, insider trading, dividend changes. | 🙂 Good free layer, optional premium. |

| Zacks | Focus on earnings revisions and value rankings. | 👍 Optional for screening strong earnings momentum stocks. |

🧠 4. Idea Generation / Community

| Platform | Use Case | Cost | My Take |

|---|---|---|---|

| Seeking Alpha Premium | Read detailed bull/bear theses, quant ratings, earnings call summaries. | ~€250 / yr | ✅ Excellent complement — adds narrative to your quantitative research. |

| The Motley Fool | Growth-stock recommendations, simple portfolio ideas. | ~€100–€300 / yr | 🙂 Optional if you like curated ideas but less data. |

⚙️ Optimal Combination for You (Balanced Stack)

| Category | Platform | Why |

|---|---|---|

| Core Fundamentals | Morningstar Premium | Analyst depth + ETF/fund coverage |

| Macro/Data Analytics | Koyfin | Visual macro & fundamentals overview |

| Screening | Finviz Elite | Best US stock filters + alerts |

| Charting | TradingView Premium (already have) | Excellent charting/alerts |

| Idea Generation | Seeking Alpha Premium | Research opinions & quant scores |

| Free Context Tool | Investing.com (Free) | Economic calendar, news |

Annexes

recap

| Platform | Type | Coverage | Asset Classes | Free Tier | Indicative Price (€/yr) | Key Strengths | Limitations | Best For | Role In Stack | Our Reco (Mid/Long-Term) | Notes |

| Investing.com / InvestingPro | Portal + Fundamentals (Pro) | Global, multi-asset | Equities, ETFs, FX, Commodities, Indices, Bonds, Crypto | Yes (ads) | ~€200–€300 (Pro) | Very broad global data; calendars; mobile apps; Pro adds fundamentals/valuation metrics | Less depth than pro-grade research; free tier delayed/ads | Global overview + quick checks | Context dashboard | Recommended (as free or Pro if you want fundamentals) | Good complement to deeper research tools |

| Yahoo Finance / Premium | Portal + Portfolio + Screeners | Global (US strongest) | Equities, ETFs, Funds, Indices, Crypto (limited) | Yes | ~€300–€400 | Popular portfolio tools; news aggregation; technical/fundamental screeners (premium) | Premium value debated; not specialist depth | General tracking + alerts | General dashboard | Optional | Free tier is often enough alongside other tools |

| Morningstar Premium | Independent Research + Fundamentals | Global (strong for funds/ETFs) | Equities, ETFs, Funds, Fixed Income | Limited | ~€250–€300 | Deep data; analyst reports; star/medalist ratings; portfolio X-ray | Premium cost; slower cadence for traders | Long-term, fund/ETF-heavy investors | Core research | Highly Recommended | Excellent for European investors comparing funds/ETFs |

| Simply Wall St | Fundamentals (visual) | Global | Equities, ETFs (limited) | Limited | ~€120–€200 | Great visual ‘snowflake’; quick company health snapshot; easy to use | Less depth on macro/real-time; not for traders | Mid/long-term stock pickers | Core fundamentals visualizer | Recommended | Nice complement to Morningstar or Koyfin |

| Koyfin | Data Visualization + Analytics | Global | Equities, ETFs, Macro, FX, Rates | Yes (limited) | ~€250–€500 | Powerful charts/dashboards; macro + fundamentals; custom watchlists | Learning curve; some features paywalled | DIY analysts, long-term investors who want visuals | Core analytics | Highly Recommended | Bridges macro + company fundamentals well |

| YCharts | Professional Analytics | Global (US strongest) | Equities, ETFs, Funds, Macro | No | €2,000+ | Institutional-level charting/data; factor analytics | Expensive for retail | Power users/professionals | Advanced (optional) | Not Necessary (retail) | Overkill unless you need pro features |

| Stock Rover | Fundamental Screener + Portfolio | US/Canada primarily | Equities, ETFs, Funds | Limited | ~€200–€400 | Very deep fundamentals screener; portfolio tracking | US-centric; UI dense | Fundamental screeners (US) | Alternative to Finviz/Koyfin | Optional (if US-heavy) | Pair with a global portal if outside US |

| Stockopedia | Quant Scoring + Screener | UK/Europe strong | Equities | No (trial) | ~€180–€300 | Quality/Value/Momentum scores; great for EU/UK small/mid caps | Less US focus; equities only | European value/quality investors | EU quant screener | Recommended (EU focus) | Good complement for Paris-based investor |

| TIKR | Global Fundamentals + Filings | Global (broad) | Equities | Limited/waitlist at times | ~€120–€300 | Global coverage; transcripts/filings; clean UI | Feature set evolving; availability varies | Global stock research | Deep-dive fundamentals | Recommended | Great for diving into non-US names |

| TipRanks | Analyst Ratings Aggregator | US/global (analyst-dependent) | Equities, ETFs (some), Crypto (some) | Yes (limited) | ~€200–€350 | Analyst/insider tracking; Smart Score | Coverage varies; paywall for depth | Sentiment/ratings check | Ratings overlay | Optional | Use to sanity-check consensus upside |

| MarketBeat | Ratings + Insider + Dividends | US-focused | Equities | Yes (limited) | ~€150–€300 | Upgrades/downgrades feed; insider trades | US-centric; limited global | US equities rating flow | Ratings overlay | Optional (US focus) | Complement US screeners |

| Zacks Investment Research | Earnings + Ratings | US-focused (global tickers present) | Equities, ETFs, Funds | Yes (limited) | ~€250–€400 | Earnings revisions; ranking system | US bias; premium tiers | Earnings-driven investors | Ratings overlay | Optional | Pairs with fundamentals platform |

| Finviz / Finviz Elite | Equity Screener + Heatmaps | US primarily | Equities, ETFs | Yes (ads, delayed) | ~€300 | Fast visual screening; heat maps; news integration | US-centric; delayed data on free | Quick US equity screens | Screening | Recommended (if US exposure) | Use alongside a fundamentals tool |

| TradingView | Charting + Social | Global data providers | Equities, FX, Crypto, Futures | Yes | ~€155–€600 (tiers) | Best-in-class charting; community ideas | Less deep fundamentals; social noise | Technical overlays on long-term ideas | Charting | Optional | Great charts even for long-term entries |

| Seeking Alpha (Premium) | Contributor Research + Ratings | Global tickers | Equities, ETFs | Yes (limited) | ~€250–€300 | Large library; quant/analyst ratings | Quality varies; paywalled articles | Idea discovery + research triangulation | Idea source | Recommended | Use for bull/bear cases |

| The Motley Fool | Stock Picks + Education | US (some global) | Equities | Limited | Varies (€100–€400+) | Curated picks; beginner-friendly explanations | Not a data tool; subscription upsells | Idea generation (growth) | Optional ideas | Optional | Always do your own due diligence |

| GuruFocus | Value Metrics + Screeners | Global (US strong) | Equities, ETFs (limited) | Limited | ~€300–€1,000 (by region) | Valuation models; GF Value; insider data | Pricey tiers; UI dated | Value investors | Valuation overlay | Optional | Check region plan (Europe) |

| Finbox | Valuation Models + API | Global (US strongest) | Equities | Limited | ~€180–€400 | DCF/comps templates; exportable models | DIY-heavy; fewer opinions | DIY valuation work | Valuation | Optional | Great if you like Excel modeling |

| AAII (American Assoc. of Individual Investors) | Education + Screens + Community | US | Equities, ETFs, Funds | No (low-cost) | ~€50–€450 (tiers) | Model screens; education; sentiment surveys | US focus; simpler tools | Lifelong learning + classic factor screens | Education/tools | Optional | Good value for education |

| Bloomberg Terminal | Institutional Terminal | Global, all assets | All | No | €22,000+ | Unmatched real-time data & news | Very expensive | Institutions | Not for retail | No (overkill) | FYI only |

| Refinitiv Eikon / LSEG Workspace | Institutional Terminal | Global, all assets | All | No | €15,000+ | Institutional data, research access | Very expensive | Institutions | Not for retail | No (overkill) | FYI only |