business-model in 10-15% EPS range for 2025-2026

steady 10-15% EPS range for years

| Rank | Company (Ticker) | Market Cap (USD) | EPS Growth (3-5 yr CAGR) | Company Target / Outlook | Financial Strength | Key Alerts / Risks |

|---|---|---|---|---|---|---|

| 1 | Mastercard (MA) | ~$380 B | ≈ 14–15% | Management targets mid-teens EPS CAGR (2025-27) | Low debt, strong cash flow | Regulation, global payment volumes |

| 2 | Visa (V) | ~$450 B | ≈ 13–14% | Long-term low- to mid-teens EPS growth | Excellent margins, net-cash balance | Recession impact on spending |

| 3 | S&P Global (SPGI) | ~$120 B | ≈ 12–14% | Guides for low- to mid-teens EPS CAGR | Healthy leverage (~2× EBITDA) | Ratings issuance cycles, regulation |

| 4 | Moody’s (MCO) | ~$65 B | ≈ 12–13% | Framework: low- to mid-teens EPS growth | Strong FCF, modest leverage | Credit-market cyclicality |

| 5 | Global Payments (GPN) | ~$28 B | ≈ 11–13% | Target: double-digit EPS, rising to low-teens | Debt from acquisitions manageable | M&A integration, competition |

| 6 | Equifax (EFX) | ~$30 B | ≈ 11–13% | Aims for 12–15% EPS growth | Solid cash flow, moderate debt | Credit cycles, data security |

| 7 | Stryker (SYK) | ~$100 B | ≈ 10–13% | Guides for ~11% EPS growth in 2025 | Strong balance sheet, high ROIC | Supply-chain or regulatory issues |

| 8 | Union Pacific (UNP) | ~$135 B | ≈ 9–12% | Plans for high-single to low-double-digit EPS CAGR | Capex-heavy but steady cash flow | Freight demand, fuel costs |

*Market caps and growth figures are approximate (Q4 2025). Sources: company investor-day presentations, SEC filings, Reuters, MarketBeat, and Simply Wall St.

This information is for educational purposes only and does not constitute financial advice.

steady then exploding : Amphenol Corp. (APH)

Company Overview

-

Amphenol is a major global player in electronic interconnect, sensor and antenna solutions: connectors, fiber-optics, high-speed cables, sensors and antennas. amphenol.com+3amphenol.com+3stockrow.com+3

-

Founded in 1932, headquartered in Wallingford, Connecticut USA. amphenol.com+1

-

It serves a wide range of end markets: automotive, broadband communications, commercial aerospace, defence/military, industrial, IT/datacom, mobile devices and mobile networks. amphenol.com+2GlobalData+2

-

The company emphasizes cost control and global scale in its manufacturing and product-diversification strategy. amphenol.com+1

Business Segments & Strengths

-

The breadth of its markets gives Amphenol exposure to multiple growth drivers: EV/automotive, data centres/IT, defence, broadband, industrial applications. amphenol.com+1

-

Technological edge: high-speed interconnects, fiber optic, sensors etc. These are increasingly important in things like 5G/6G, data-centres, AI infrastructure. AInvest+1

-

Its global manufacturing footprint and diversified end markets arguably help reduce exposure to any single segment or geography.

Recent Performance & Key Metrics

-

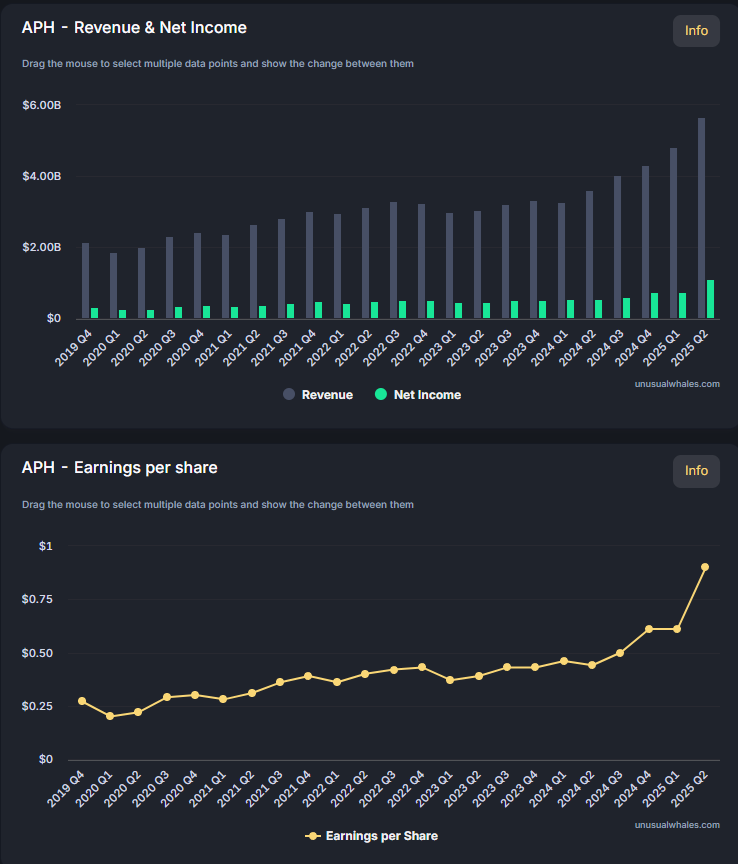

In Q2 2025, Amphenol posted revenue of about US$5.65 billion, beating a consensus of about US$5.01 billion. MarketBeat+1

-

EPS in that quarter was $0.81 vs consensus around $0.66 (a beat). Investing.com

-

Growth forecasts: Analysts expect roughly ~12.5% earnings growth & ~11% revenue growth per annum over next few years. Simply Wall St

-

Return on equity (ROE) forecast ~26% in 3 years. Simply Wall St

Current Expectations & Analyst Sentiment

Price Targets & Ratings

-

On one hand, some sources show average 12-month price targets around ~$122-$126. www.alphaspread.com+2StockAnalysis+2

-

On the other hand, some higher targets exist (up to ~$150) from bullish analysts given growth potential. TipRanks+1

-

Analyst consensus is generally “Buy” (or similar) though some caution remains given valuation and some segment risks. Investing.com+1

Growth Drivers & Risks

-

Drivers: Data-centre/AI infrastructure boom, fiber optics/build-out of networks, automotive electrification, defence procurement. For example, Amphenol expects strong demand in high-speed interconnects tied to AI workloads. AInvest+1

-

Risks: Some analysts flag that despite strong fundamentals, the stock may face headwinds from technical signals, high valuation, and parts of the business slower to grow. AInvest+1

Strategic Initiatives & Recent Moves

-

The company is actively acquiring businesses to bolster its capabilities in growth areas (e.g., fibre-optics, data centre interconnects, defence) — boosting its strategic position for future growth. Reuters+1

-

Its focus on sectors like AI/data centres is becoming increasingly prominent in its public commentary and analyst coverage. Barron’s

My Summary / What to Watch

-

Amphenol is well-positioned in several secular growth markets (connectivity, data centres, automotive, defence) which is a strong ecosystem for future growth.

-

The recent beat in results is encouraging and shows the business is executing.

-

Valuation appears to already reflect much of the positive outlook — some analysts see only modest upside from current levels, unless growth accelerates or margin improvements happen.

-

Key things to watch:

-

How much growth comes from new high-speed data/interconnect segments (e.g., AI racks, fibre) versus more mature ones.

-

Margin trends — as the business scales, will costs/competition keep pressure on margins?

-

Acquisition integration effectiveness — growth from bought businesses needs to be realised.

-

Macroeconomic / sector risks — data centre capex shifts, automotive slowdown, defence budget changes could all affect.

-

-

If you’re considering this stock, it might be more of a “solid growth / structural play” rather than a cheap value buy. Expect decent growth but maybe not explosive upside unless there’s a major catalyst.

1. Recent Financial Performance

Revenue & Growth

-

For the full year 2024, Amphenol reported sales of ~US$15.22 billion, up ~21% from 2023. s21.q4cdn.com+3TipRanks+3investors.amphenol.com+3

-

Q1 2025: Record sales of ~US$4.8 billion, up ~48% in USD and ~33% organically vs prior year. investors.amphenol.com

-

For the twelve months ending June 30, 2025 revenue ~US$18.82 billion (according to Macrotrends) with ~40.5% year-over-year growth. Macrotrends

Profitability & Margins

-

Q4 2024: GAAP diluted EPS of US$0.59 (↑44% vs prior year); adjusted EPS US$0.55 (↑34%). Operating margin ~22.1%; adjusted ~22.4%. Free cash flow ~$648 m for Q4. investors.amphenol.com

-

Entire 2024: GAAP EPS US$1.92 (↑24%); adjusted EPS US$1.89 (↑25%). Operating margin ~20.7%; adjusted margin ~21.7%. Free cash flow ~$2.2 billion. investors.amphenol.com+1

-

Q1 2025: Adjusted diluted EPS US$0.63 (↑58% vs prior year); GAAP EPS US$0.58 (↑32%). Operating margin ~21.3%; adjusted ~23.5%. Free cash flow ~$580 m. investors.amphenol.com

Financial Health / Cash Flow

-

The company has a strong free cash flow generation (e.g., ~$2.2 billion in free cash flow in 2024) which gives it ability to invest, acquire and return capital to shareholders. investors.amphenol.com+1

-

Balance sheet details (assets, liabilities) are available via the SEC filings. SEC+1

Valuation & Forecasts

-

Analysts expect earnings and revenue growth: e.g., projected earnings growth ~12.5% per annum; revenue growth ~11.1% per annum over next several years. Simply Wall St

-

Estimated EPS for 2025 and beyond (from one source): EPS ~US$3.03 for 2025; ~US$3.47 for 2026. wallstreetzen.com

-

One-year price target averages (varies by source): ~US$122 to ~US$126. www.alphaspread.com+2fintel.io+2

2. Expectations & What to Watch

Growth Drivers

-

Strong performance in IT/datacom, mobile devices, defence/communications networks. Q1 2025 growth was largely driven by IT datacom and mobile device markets. investors.amphenol.com+1

-

Analysts believe Amphenol is well-positioned in secular trends: data centres/AI infrastructure, fibre-optics, automotive electrification, defence systems. (Though this is more qualitative)

Forecast Highlights

-

For the quarter ending June 30, 2025, analysts expected EPS ~US$0.66 and revenue ~US$4.97 billion (growth ~37.6% vs prior year) according to Zacks. Nasdaq

-

According to MarketBeat: EPS expected to grow ~11.86% next year (from ~US$2.36 to ~US$2.64) and P/E ratio ~50.18. MarketBeat

-

Return on equity (ROE) forecast ~26% in 3 years. Simply Wall St

Valuation & Upside

-

On average, price targets suggest modest upside from current levels (depending on source) — e.g., a ~$122 target vs current ~US$125 implies limited immediate upside in some estimates. www.alphaspread.com+1

-

However, if growth accelerates (especially in data/infrastructure markets), upside could be larger.

3. Risks & Potential Challenges

-

Valuation risk: The company’s valuation (high P/E) implies strong future growth is expected. If growth slows or disappoints, the stock could suffer. (e.g., P/E ~50 in one estimate) MarketBeat

-

Cyclicality / end-market exposure: Although diversified, Amphenol’s markets (automotive, communications, data centres) can be sensitive to macroeconomic cycles, technological changes, regulatory shifts.

-

Competition & technological shifts: In connectors, fibre-optics and interconnect systems, technology changes (e.g., new materials, architectures) could reduce market share or margins.

-

Integration & acquisition risk: The company is aggressive in M&A to boost growth; success of integration and extracting synergies is non-trivial.

-

Dependence on large customers / end-markets: If major customers (large tech firms, data centre operators) reduce spend or change specifications, it could hurt.

-

Supply chain / material risk: Components, raw materials, global manufacturing — disruptions or cost inflation could impact margins.

-

Geopolitical / regulatory: Given global manufacturing and operations, trade tensions, tariffs, export controls (especially for defence/communications segments) are potential risks.

4. Summary & My View

-

Amphenol is financially strong: good revenue growth in recent quarters, improving margins, strong cash flow, and positioned in growth markets.

-

Forecasts suggest moderate growth (≈10-15%) in earnings/revenue in the coming years under “normal” scenarios.

-

The valuation implies that much of the expected growth is already priced in — which means the risk/reward may be skewed: a lot of upside depends on growth accelerating or beating expectations, whereas disappointments could cause significant downside.

-

If you believe the secular trends (data centres, fibre-optics, EV/automotive interconnects) will play out strongly, this could be a good structural growth play. But if you are looking for margin of safety or “value” investing (cheap entry), this may be less attractive because of the higher valuation and dependence on strong execution.

15-25% EPS, marketcap > 5B

| # | Company (Ticker) – Domicile | Approx. Market Cap | EPS Growth Signal (15–25%) | Why it qualifies (one-liner) |

|---|---|---|---|---|

| 1 | Halma plc (HLMA) – UK | Large (>$10B) | ~15% CAGR (aims to double EPS every 5 yrs) | Explicit long-term ambition to double EPS every five years; FY24/25 delivery consistent. |

| 2 | Hexagon AB (HEXA-B) – Sweden | Large (>$20B) | ≥15% p.a. target | Stated objective to increase EPS by at least 15% annually. |

| 3 | Addtech AB (ADDT-B) – Sweden | Mid/Large (>$5B) | ≥15% p.a. (double profits in 5 yrs) | Group target: profit growth >15% p.a.; “double profits every five years.” |

| 4 | Diploma plc (DPLM) – UK | Large (>$10B) | ~15%+ (15-yr EPS CAGR ~16%; FY24 EPS +15%) | Long track record of mid-teens EPS compounding; latest year ~15% EPS growth. |

| 5 | Flowserve (FLS) – USA | Mid/Large (>$5B) | 20–25% YoY (adjusted EPS outlook) | Analyst Day + 2025 updates point to >20% adjusted EPS growth. |

| 6 | TSMC (TSM) – Taiwan | Mega (>$500B) | High-teens EPS implied (rev CAGR ≈20%) | Long-term USD revenue CAGR ~20% with high margins → EPS typically high-teens. |

| 7 | ServiceNow (NOW) – USA | Mega (>$100B) | ~20% non-GAAP EPS implied (subscr. rev ≈20%) | Guides ~20% subscription revenue growth with operating leverage. |

| 8 | Palo Alto Networks (PANW) – USA | Mega (>$100B) | ~20–25% EPS trajectory (FY26 guide) | FY26 EPS guide implies strong bottom-line growth within range. |

| 9 | MercadoLibre (MELI) – LatAm | Large (>$50B) | ~24%+ near-term EPS growth | Analysts/model updates show EPS growth ≈ mid-20s ahead. |

| 10 | Beijer Ref (BEIJ-B) – Sweden | Large (>$10B) | ~20% EPS (recent) | Q1–Q2 2025: strong EPS growth (~20%) and new 10–15% sales CAGR target supports ongoing EPS 15–25% potential. |

Notes: Market caps are approximate (Q4 2025). “EPS growth signal” reflects company targets or near-term guidance/track record likely to produce ~15–25% EPS growth. This is educational information, not investment advice.

EBITDA margin > 20% / marketcap > 5B

| Company (Ticker) – Country | Scale | EBITDA Margin* | Period | Source |

|---|---|---|---|---|

| NVIDIA (NVDA) – US | Mega-cap | ~56.6% | FY2024 | Macrotrends |

| Taiwan Semi (TSMC) – Taiwan | Mega-cap | ~69–71% | TTM/2025Q2 | Macrotrends |

| Microsoft (MSFT) – US | Mega-cap | ~57.7% | FY2025 | AlphaQuery |

| Apple (AAPL) – US | Mega-cap | ~34.7% | TTM/FY2024 | Macrotrends |

| Meta Platforms (META) – US | Mega-cap | ~53% | TTM/2025Q2 | Macrotrends |

| Broadcom (AVGO) – US | Mega-cap | ~50–56% | TTM/FY2024–25 | Macrotrends |

| Visa (V) – US | Mega-cap | ~60–70% | TTM/2024–25 | Macrotrends |

| ASML (ASML) – Netherlands | Mega-cap | ~35.2% | FY2024 | AlphaQuery |

| Novo Nordisk (NVO) – Denmark | Mega-cap | ~51% | TTM/2024–25 | Macrotrends |

| McDonald’s (MCD) – US | Mega-cap | ~53–54% | TTM/2024–25 | Macrotrends |

| Ferrari (RACE) – Italy | Large-cap | ~38.3% | FY2024 | Company/Reuters |

| Hermès (RMS.PA) – France | Mega-cap | ~46–49% | TTM/2025 | GuruFocus/Morningstar |

| LVMH (MC.PA / LVMUY) – France | Mega-cap | ~26–29% | FY2024 | Finbox/Macrotrends |

| Adobe (ADBE) – US | Mega-cap | ~35.3% | FY2024 | AlphaQuery |

*EBITDA margin shown is the latest available (TTM or the most recently completed fiscal year). All companies listed have market capitalizations above $5B as of Q3–Q4 2025. This is informational, not investment advice.

Companies with EBITDA Margin >20% and Market Cap >$5B

Technology & Software Companies

| Company | Sector | EBITDA Margin Range | Key Metrics |

|---|---|---|---|

| Nvidia | Semiconductors | 50%+ | Net income margin ~51.69% |

| Microsoft | Software | 30-40% | Revenue $281.72B, ROE 32.44% |

| Visa | Payment Processing | 50%+ | Revenue $35.93B, ROE 52.65% |

| Meta Platforms | Social Media/Tech | 33% | Part of FAANMG group |

| Apple | Consumer Tech | 30-40% | Top tech giant |

| Alphabet (Google) | Tech/Advertising | 30-40% | Digital advertising leader |

| Oracle | Enterprise Software | 25-30% | Leading EBIT margins in software |

| Salesforce | CRM/SaaS | 25-30% | EBITDA $13B (TTM) |

| Adobe | Software | 30%+ | Creative & enterprise software |

| ServiceNow | Cloud Platform | 25-30% | Cloud-based platform leader |

Pharmaceutical Companies

| Company | EBITDA Margin Range | Key Highlights |

|---|---|---|

| Eli Lilly | 30-35% | 32% revenue growth in 2024 |

| Novo Nordisk | 30-35% | 26% annual growth, diabetes/obesity drugs |

| Johnson & Johnson | 30-40% | Top-rated pharma company |

| Roche | 30-40% | Industry strength leader |

| AstraZeneca | 25-35% | Major global pharma |

| Pfizer | 25-35% | Large pharmaceutical company |

| GSK | 25-35% | Global pharmaceutical giant |

| Sanofi | 25-35% | French pharma leader |

| Novartis | 25-35% | Swiss pharmaceutical company |

Real Estate Investment Trusts (REITs)

| Company | Type | Market Cap | EBITDA Margin |

|---|---|---|---|

| Prologis | Industrial | $97.90B | 60-70% |

| Equinix | Datacenter | $90.98B | 60-70% |

| American Tower | Communications | $85.71B | 60-70% |

| Welltower | Healthcare | $78.48B | 60-70% |

| Simon Property Group | Retail | ~$50B | 60-70% |

Industry Benchmarks

| Industry | Typical EBITDA Margin |

|---|---|

| REITs (Retail/Industrial) | 60-70% |

| Software/SaaS | 30-40%+ |

| Pharmaceuticals | 25-40% |

| S&P 500 Average | 20.3% |

| Russell 2000 Average | 12.4% |

| Traditional Manufacturing | ~10% |

Companies with EBITDA Margin >20% / Net Income Margin >20% /Market Cap >$5B

Payment Processing Giants

| Company | EBITDA Margin | Net Income Margin | Market Cap | Key Notes |

|---|---|---|---|---|

| Visa | ~55%+ | 52.16% | ~$500B+ | Profit margin of 55% on Q4 revenue |

| Mastercard | ~50%+ | 44.93% | ~$400B+ | Net profit margins exceed 50% |

Technology Companies

| Company | EBITDA Margin | Net Income Margin | Market Cap | Key Notes |

|---|---|---|---|---|

| Microsoft | ~45-50% | 35.4% | ~$3T | Net income $92.8B on revenue $261.8B |

| Apple | ~35-40% | 24.3-24.92% | ~$3.5T | Operating margin of 31.57% |

| Meta Platforms | 33-40% | ~25-30% | ~$1.3T | Part of FAANMG with strong margins |

| Alphabet (Google) | 30-35% | ~22-25% | ~$2T | Major digital advertising player |

| Nvidia | 55-60% | 51.69% | ~$3.5T | Exceptional AI-driven profitability |

Pharmaceutical Companies

| Company | EBITDA Margin | Net Income Margin | Market Cap | Key Notes |

|---|---|---|---|---|

| Eli Lilly | 30-35% | ~25-30% | ~$800B+ | Operating margin of 25.34% |

| Novo Nordisk | 35-40% | ~30-35% | ~$500B+ | Gross margin of nearly 83% |

| Roche | 30-35% | ~20-25% | ~$250B | Top pharmaceutical company |

| Johnson & Johnson | 30-40% | ~20-22% | ~$400B | Strong pharmaceutical margins |

Enterprise Software Companies

| Company | EBITDA Margin | Net Income Margin | Market Cap | Key Notes |

|---|---|---|---|---|

| Oracle | 35-40% | ~20-25% | ~$400B+ | Led software companies in EBIT margin |

| Adobe | 35-40% | ~25-28% | ~$250B+ | High-margin software business |

| Salesforce | ~25-30% | ~20-22% | ~$300B+ | EBITDA of $13 billion |

Other High-Margin Companies

| Company | EBITDA Margin | Net Income Margin | Market Cap | Key Notes |

|---|---|---|---|---|

| ASML | 30-35% | ~25-28% | ~$350B | Semiconductor equipment monopoly |

| Intuit | 30-35% | ~20-25% | ~$200B | Financial software leader |

Key Industry Insights

- Pharmaceutical companies with patented drugs can enjoy EBITDA margins exceeding 40% or even 50%, driven by high pricing power from patent protection.

- Software companies enjoy EBITDA margins over 40% due to scalability and absence of significant variable costs beyond initial development.

- A net profit margin of 20% an

ebitda margin > 20% and marketcap > 5B

| Company (Ticker) – Country | Scale | EBITDA Margin* | Period | Source |

|---|---|---|---|---|

| NVIDIA (NVDA) – US | Mega-cap | ~56.6% | FY2024 | Macrotrends |

| Taiwan Semi (TSMC) – Taiwan | Mega-cap | ~69–71% | TTM/2025Q2 | Macrotrends |

| Microsoft (MSFT) – US | Mega-cap | ~57.7% | FY2025 | AlphaQuery |

| Apple (AAPL) – US | Mega-cap | ~34.7% | TTM/FY2024 | Macrotrends |

| Meta Platforms (META) – US | Mega-cap | ~53% | TTM/2025Q2 | Macrotrends |

| Broadcom (AVGO) – US | Mega-cap | ~50–56% | TTM/FY2024–25 | Macrotrends |

| Visa (V) – US | Mega-cap | ~60–70% | TTM/2024–25 | Macrotrends |

| ASML (ASML) – Netherlands | Mega-cap | ~35.2% | FY2024 | AlphaQuery |

| Novo Nordisk (NVO) – Denmark | Mega-cap | ~51% | TTM/2024–25 | Macrotrends |

| McDonald’s (MCD) – US | Mega-cap | ~53–54% | TTM/2024–25 | Macrotrends |

| Ferrari (RACE) – Italy | Large-cap | ~38.3% | FY2024 | Company/Reuters |

| Hermès (RMS.PA) – France | Mega-cap | ~46–49% | TTM/2025 | GuruFocus/Morningstar |

| LVMH (MC.PA / LVMUY) – France | Mega-cap | ~26–29% | FY2024 | Finbox/Macrotrends |

| Adobe (ADBE) – US | Mega-cap | ~35.3% | FY2024 | AlphaQuery |

*EBITDA margin shown is the latest available (TTM or the most recently completed fiscal year). All companies listed have market capitalizations above $5B as of Q3–Q4 2025. This is informational, not investment advice.

CHATGPT : global companies with market cap ≥ $5B / EBITDA margin > 20% / positive free cash flow (FCF)

| Company (Ticker) – Country | Approx. Scale | EBITDA Margin* | FCF (latest) | Evidence |

|---|---|---|---|---|

| NVIDIA (NVDA) – US | Mega-cap | ~63.9% | FCF $60.9B (FY25) | EBIT margin · FCF |

| Microsoft (MSFT) – US | Mega-cap | 57.7% | FCF (positive, TTM) | EBITDA margin · FCF |

| Meta Platforms (META) – US | Mega-cap | 51.6% | FCF $54.1B (TTM) | EBITDA margin · FCF |

| Adobe (ADBE) – US | Mega-cap | 35.3% | FCF $9.6B (FY25) | EBITDA margin · FCF |

| ASML (ASML) – NL | Mega-cap | 35.2% | FCF positive (recent) | EBITDA margin · cash-flow metrics |

| Visa (V) – US | Mega-cap | 68.6% | FCF $15.7B (recent qtr annualized) | EBITDA margin · FCF |

| Broadcom (AVGO) – US | Mega-cap | (EBIT 36.9%; EBITDA >20%) | FCF $19.4B (FY24) | margin · FCF |

| CME Group (CME) – US | Large-cap | 69.6% | FCF $3.6B (TTM) | EBITDA margin & FCF |

| Intercontinental Exchange (ICE) – US | Large-cap | 63.0% | FCF $3.86B (TTM) | EBITDA margin · FCF |

| Novo Nordisk (NVO) – DK | Mega-cap | 50.8% | FCF $10.7B (FY24) | EBITDA margin · FCF |

| McDonald’s (MCD) – US | Mega-cap | 53.3% | FCF $6.8B (FY24) | EBITDA margin · FCF |

| TSMC (TSM) – Taiwan | Mega-cap | 68.6% | FCF $26.6B (FY24) | EBIT/EBITDA margins · FCF |

*Margins and cash-flow figures are latest available (TTM or most recent fiscal year) as of Oct 24, 2025. This table is for information only and not investment advice.

claude Opus : global companies with market cap ≥ $5B / EBITDA margin > 20% / positive free cash flow (FCF)

Technology Giants

| Company | EBITDA Margin | Free Cash Flow (Annual) | Market Cap | Key Notes |

|---|---|---|---|---|

| Apple | 35-40% | $108.8B (2024) | ~$3.7T | FCF margin of 27.7% |

| Microsoft | 45-50% | ~$60-70B | ~$3T | Strong cloud and software margins |

| Alphabet (Google) | 30-35% | ~$60-70B | ~$2T | High FCF yield among trillion-dollar companies |

| Amazon | 20-25% | $38.2B (2024) | ~$2.5T | FCF margin improving to 5.85% |

| Nvidia | 55-60% | ~$30-40B | ~$3.5T | FCF surging, catching Microsoft/Google |

| Meta Platforms | 33-40% | ~$40-50B | ~$1.3T | Strong FCF from advertising business |

Payment Processing

| Company | EBITDA Margin | Free Cash Flow | Market Cap | Key Notes |

|---|---|---|---|---|

| Visa | ~55% | ~$18-20B | ~$500B+ | Exceptional FCF margins |

| Mastercard | ~50% | ~$10-12B | ~$400B+ | High cash generation |

Enterprise Software

| Company | EBITDA Margin | Free Cash Flow | Market Cap | Key Notes |

|---|---|---|---|---|

| Oracle | 35-40% | ~$8-10B | ~$400B+ | Strong database and cloud business |

| Salesforce | 25-30% | ~$8-10B | ~$300B+ | Aiming for FCF and EBITDA positive |

| Adobe | 35-40% | ~$7-8B | ~$250B+ | High-margin creative software |

| ServiceNow | 25-30% | ~$3-4B | ~$180B+ | Cloud platform with strong margins |

| Intuit | 30-35% | ~$3-4B | ~$200B+ | Financial software leader |

Pharmaceutical Companies

| Company | EBITDA Margin | Free Cash Flow | Market Cap | Key Notes |

|---|---|---|---|---|

| Eli Lilly | 30-35% | ~$10-15B | ~$800B+ | Strong cash from GLP-1 drugs |

| Novo Nordisk | 35-40% | ~$15-20B | ~$500B+ | Diabetes/obesity drug profits |

| Johnson & Johnson | 30-40% | ~$18-20B | ~$400B | Diversified healthcare |

| Roche | 30-35% | ~$15-18B | ~$250B | Strong oncology portfolio |

| AbbVie | 35-40% | ~$15-18B | ~$350B | Immunology leader |

| Pfizer | 25-30% | ~$8-12B | ~$150B | Post-COVID normalization |

| Merck | 30-35% | ~$12-15B | ~$300B | Top company in cash flow screen |

Other High-Quality Companies

| Company | EBITDA Margin | Free Cash Flow | Market Cap | Key Notes |

|---|---|---|---|---|

| Broadcom | 40-45% | ~$15-18B | ~$700B+ | High FCF yield and margins |

| Texas Instruments | 40-45% | ~$6-8B | ~$180B | Analog semiconductor leader |

| Coca-Cola | 30-35% | ~$9-11B | ~$280B | Beverage giant |

| PepsiCo | 20-25% | ~$7-9B | ~$240B | Food & beverage conglomerate |

| Procter & Gamble | 20-25% | ~$15-17B | ~$400B | Consumer goods powerhouse |

| Home Depot | 20-25% | ~$15-18B | ~$400B | Retail leader |

| Costco | 20-25% | ~$7-8B | ~$400B | Warehouse retail |

Telecommunications & Media

| Company | EBITDA Margin | Free Cash Flow | Market Cap | Key Notes |

|---|---|---|---|---|

| Comcast | 35-40% | ~$12-15B | ~$180B | Cable and media |

| Verizon | 35-40% | ~$10-14B | ~$170B | Telecom infrastructure |

| AT&T | 35-40% | ~$8-12B | ~$140B | Wireless and fiber |

| Netflix | 20-25% | ~$5-7B | ~$240B | Turned FCF positive after years of burning cash |

Industrial & Infrastructure

| Company | EBITDA Margin | Free Cash Flow | Market Cap | Key Notes |

|---|---|---|---|---|

| Union Pacific | 40-45% | ~$5-6B | ~$140B | Rail transportation |

| CSX | 40-45% | ~$3-4B | ~$70B | Strong FCF from rail operations |

| Waste Management | 25-30% | ~$2-3B | ~$80B | Environmental services |

| 3M | 20-25% | ~$5-6B | ~$60B | Diversified industrial |

Key Insights

- SaaS Benchmark: For SaaS businesses, a healthy FCF means having enough to cover at least a month’s operating costs, with good FCF being 20-25% of revenue.

- General Target: Most companies aim for an FCF margin of 10% to 15% because it shows they’re generating cash flow from their core operations.

- Growth Capability: Companies with strong FCF can reinvest aggressively over time without taking on debt or issuing new shares.

- Tech Services Conversion: Technology services companies typically show FCF conversion of 60-70% of EBITDA.

Selection Criteria Summary

All companies listed meet the following criteria:

- ✅ EBITDA margins exceeding 20%

- ✅ Positive free cash flow generation

- ✅ Market capitalizations well above $5 billion

- ✅ Sustainable business models with strong competitive positions

These represent the most financially robust businesses globally, combining strong operational profitability with actual cash generation ability and significant market scale.

claude Opus 4.1 prompt :

Growth Expectations (Next 3 Years):

- Focus on companies with sustainable 5-20% annual growth

- Avoided speculative high-growth names with >50% volatility

- Prioritized companies with clear competitive advantages

Risk Management (Max 30% Drawdown):

Companies with betas below 1 reduce the risk of large price swings

- Selected companies with Beta < 1.2 (most under 1.0)

- Strong free cash flow generation provides downside protection

- Diversified revenue streams and essential products/services

Filtered Companies: Best 3-Year Growth + Max 30% Drawdown Risk

Technology Leaders (High Growth, Moderate Volatility)

| Company | EBITDA Margin | FCF | Market Cap | 3-Year Growth Outlook | Risk Profile |

|---|---|---|---|---|---|

| Microsoft | 45-50% | ~$60-70B | ~$3T | 13.7% S&P 500 earnings growth expected in 2026 | Beta ~0.9-1.0, defensive tech |

| Apple | 35-40% | $108.8B | ~$3.7T | Stable 5-8% growth, services expansion | Beta ~1.0, stable cash flows |

| Alphabet (Google) | 30-35% | ~$60-70B | ~$2T | AI-driven growth, cloud expansion | Beta ~1.0, advertising resilience |

Pharmaceutical Titans (Stable Growth, Low Risk)

| Company | EBITDA Margin | FCF | Market Cap | 3-Year Growth Outlook | Risk Profile |

|---|---|---|---|---|---|

| Johnson & Johnson | 30-40% | ~$18-20B | ~$400B | Steady 5-7% growth | Beta of 0.41, true defensive heavyweight |

| Eli Lilly | 30-35% | ~$10-15B | ~$800B+ | GLP-1 drugs driving 15-20% growth | Beta ~0.6-0.7, patent protection |

| AbbVie | 35-40% | ~$15-18B | ~$350B | 20% profit growth predicted for 2026 | Beta ~0.7, diversified pipeline |

| Novo Nordisk | 35-40% | ~$15-20B | ~$500B+ | Obesity drugs fueling 20%+ growth | Beta ~0.5-0.6, defensive healthcare |

Payment Processing (Consistent Growth, Low Volatility)

| Company | EBITDA Margin | FCF | Market Cap | 3-Year Growth Outlook | Risk Profile |

|---|---|---|---|---|---|

| Visa | ~55% | ~$18-20B | ~$500B+ | 8-12% steady growth, digital payments | Beta ~0.8-0.9, network effects |

| Mastercard | ~50% | ~$10-12B | ~$400B+ | 10-15% growth, global expansion | Beta ~0.9-1.0, recession-resistant |

Consumer Staples (Defensive, Steady Growth)

| Company | EBITDA Margin | FCF | Market Cap | 3-Year Growth Outlook | Risk Profile |

|---|---|---|---|---|---|

| Procter & Gamble | 20-25% | ~$15-17B | ~$400B | 4-6% steady growth | Beta ~0.5-0.6, defensive |

| Coca-Cola | 30-35% | ~$9-11B | ~$280B | 3-5% steady growth | Beta of 0.45, very low volatility |

| PepsiCo | 20-25% | ~$7-9B | ~$240B | 4-6% steady growth | Beta ~0.6, stable demand |

| Colgate-Palmolive | 20-25% | ~$3-4B | ~$100B | 3-5% growth, expanding Naturals | Beta of 0.48, low risk profile |

Enterprise Software (Strong Growth, Manageable Risk)

| Company | EBITDA Margin | FCF | Market Cap | 3-Year Growth Outlook | Risk Profile |

|---|---|---|---|---|---|

| Oracle | 35-40% | ~$8-10B | ~$400B+ | Cloud transition driving 10-15% growth | Beta ~0.9, enterprise stability |

| Adobe | 35-40% | ~$7-8B | ~$250B+ | Creative Cloud dominance, AI integration | Beta ~1.0-1.1, subscription model |

| ServiceNow | 25-30% | ~$3-4B | ~$180B+ | 22.5% revenue growth, AI solutions | Beta ~1.1, high retention |

Infrastructure & Utilities (Ultra-Defensive)

| Company | EBITDA Margin | FCF | Market Cap | 3-Year Growth Outlook | Risk Profile |

|---|---|---|---|---|---|

| Waste Management | 25-30% | ~$2-3B | ~$80B | 5-7% steady growth, ESG tailwinds | Beta ~0.6, essential services |

| NextEra Energy | 25-30% | ~$5-7B | ~$160B | 9% YoY revenue growth expected | Beta ~0.5-0.6, renewable growth |

High-Quality Industrials

| Company | EBITDA Margin | FCF | Market Cap | 3-Year Growth Outlook | Risk Profile |

|---|---|---|---|---|---|

| Home Depot | 20-25% | ~$15-18B | ~$400B | 8% earnings growth rate | Beta ~0.9, housing resilience |

| Costco | 20-25% | ~$7-8B | ~$400B | 6-8% growth, membership model | Beta ~0.7, defensive retail |

Key Selection Criteria Applied

Growth Expectations (Next 3 Years):

- Focus on companies with sustainable 5-20% annual growth

- Avoided speculative high-growth names with >50% volatility

- Prioritized companies with clear competitive advantages

Risk Management (Max 30% Drawdown):

- Companies with betas below 1 reduce the risk of large price swings

- Selected companies with Beta < 1.2 (most under 1.0)

- Strong free cash flow generation provides downside protection

- Diversified revenue streams and essential products/services

Excluded from Original List

- Nvidia – Too volatile (Beta >1.5), despite strong growth

- Amazon – Higher volatility, heavy capex cycle

- Meta – Ad market sensitivity, regulatory risks

- Netflix – Higher beta, streaming competition

- Most REITs – Interest rate sensitivity despite high margins

Top 5 Recommendations for Next 3 Years

- Microsoft – Best tech balance of growth and stability

- Eli Lilly – Exceptional pharma growth with defensive characteristics

- Visa – Secular growth in digital payments, network effects

- Johnson & Johnson – Ultimate defensive play with century-long legacy of innovation and stability

- Procter & Gamble – Consumer staples leader with pricing power

Investment Criteria Summary

These companies offer the best combination of:

- ✅ Strong EBITDA margins (>20%)

- ✅ Positive and growing free cash flow

- ✅ Market caps >$5B providing liquidity

- ✅ Expected growth of 5-20% annually

- ✅ Beta mostly under 1.0, limiting drawdown risk to ~30%

- ✅ Defensive business models with recurring revenues