20251104 big TECH battle for best valuation !

Dans la liste des Mag7, j’ai viré TSLA depuis un moment.. le seul qui doit etre timé precisement pour valoir quelque chose !

Guetter les news d’Optimus et le passage d’une compagnie qui produit des voitures en concurrence avec la Chine (mauvaise idée) à une boite qui fait de la robotique et tout ce qui sert à faire tourner les bots : principalement IA et énergie..

20251104 big TECH news et PER, risque de crash immédiat ?

Ma petite expérience m’a montré que contrairement à ce que nous apprennent les belles phrases des « mentors » comme W.Buffet, le PER n’a pas d’incidence directe sur les cours : si un PER arrive par ex à 50% au dessus de la moyenne de son secteur, ca ne fera rien au cours.

On peut voir ca comme une mesure de popularité de l’asset qui a pris tous les financements du secteur car les attentes sont plus hautes que dans ses concurrents.

Néanmoins on a un élément indirect : les personnes qui ont bien intégré le message de W.Buffet deviennent tres nerveuses lorsque le PER ss’envole et sont pretes à tout lacher au moindre signe de faiblesse de la trend.

Donc au final il faut s’interesser aux compagnies qui ont un PER anormalement élevé et vérifier le sens et le niveau de surprise qu’elle fournissent tous les trimestres(quarters).

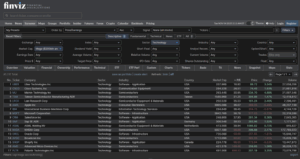

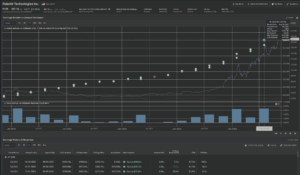

Prenons la pire/meilleure ? de toutes, celle qui a pris tous les suffrages et qui caracole en tete des PER du secteur Tech : Palantir.

A 688 de PER, Palantir est carrément hors jeu selon les critères de W.Buffet, pourquoi le cours se tient-il encore (pour l’instant) ?

Voici la réponse :

Mais attention à n’importe quelle mauvaise nouvelle : meme avec des résultats fabuleux, des marges incroyables, du cash-flow qui déborde, une cotation avec un PER aussi élevé peut tomber à chaque instant !

Parce que le nombrer de personnes qui jouent la baisse augmentent à mesure que le PER va dans le rouge – et ceux la placent des sommes folles à levier sur la baisse, le plus connu est Mickael Burry (le gars du Big Short) qui a justement en ce moment un PUT énorme sur PLTR !

Donc au moindre accroc, un seul indicateur un peu faible, c’est le crash ! Mais bon on ne connait pas la taille que fera la chadelle rouge, si ca suit pas chez les bearish, ca peut tomber de 5 ou 10% et c’est fini. Après tout les fondamentaux de PLTR sont en béton et les contrats d’Etat sont derriere.

Pour l’instant et contrairement à ce qu’on lit dans la presse débile – pardon francaise – y’a pas vraiment de bulle IA au sens ou la demande correspond aux investissements et on peut meme dire que les invests ne suivent pas la demande puisqu’on a meme des sociétés qui n’arrivent plus à ajouter des capacités de calcul par manque d’énergie ! Et pourtant on voit les revenus qui sont bien la, tout les pros ont des contrats ou des abonnements payants avec l’iA, ca ne suit juste pas au niveau production.

Donc au final la seule bulle IA qui peut engendrer un crash de tout le secteur et par conséquent de tout le SP500(la bigTech représente 40% du SP500), c’est celle qui est formée par les acteurs principaux OpenAI et Nvidia qui distribue des milliards a des sociétés avec lesquelles elles travaillent au travers d’accords vérouillés sur plusieurs années alors que ces milliards ne sont pas encore levés/disponibles.

20251031 clouds market - Azure -Google - AWS

20251031 Poolside AI (generative AI tools for software development) raised large amounts of capital - private equity only for now

The startup Poolside AI (sometimes just “Poolside”) appears not to be tradeable at this time — here’s a breakdown of what I found and what it means if you’re thinking about investing.

✅ What we do know

-

Poolside AI is a private company building generative AI tools for software development (code generation, IDE integrations, enterprise-oriented) with models called Malibu and Point. poolside.ai+2aimresearch.co+2

-

They have raised large amounts of capital. For example: a ~$500 million Series B round in 2024 that reportedly valued them at ~$3 billion. techcrunch.com+2SiliconANGLE+2

-

The company is still at a “private” stage: according to research profiles, “status: Private / Stage: Series B” for Poolside.

20251030 grosse chute META ! buy the dip ? (j'ai pris une position)

20251030 OpenAI IPO could value the company at up to $1 trillion ! target 2026-2027

✅ What the report says

According to Reuters:

-

OpenAI is laying the groundwork for an initial public offering (IPO) that could value the company at up to $1 trillion. Reuters+2Crypto Briefing+2

-

The company is targeting a filing with securities regulators perhaps as early as the second half of 2026, with a listing possibly in 2027. Investing.com+2Reuters+2

-

The IPO might aim to raise at least $60 billion at the low end. Reuters+1

-

While the IPO is under discussion, OpenAI emphasizes that its focus remains on building a “durable, mission-driven business” rather than simply going public for the sake of it. Reuters

🧮 Key context & background

To make sense of this, here are some important background facts:

-

In early Oct 2025, OpenAI reportedly reached a valuation of about $500 billion following a major share sale of current/former employee stakes. Reuters+2Reuters+2

-

OpenAI’s annualised revenue run-rate is reported to be around $10 billion (or more) by mid-2025, and some sources suggest a target of ~$20 billion by year-end. Reuters+2Reuters+2

-

There has been a major restructuring of OpenAI’s corporate/governance setup: a nonprofit parent (the OpenAI Foundation) holds a stake, there is a for-profit arm, etc. This is relevant because public-market readiness often depends on clear governance and share structure. Investing.com+2Reuters+2

🎯 Why it matters

-

If OpenAI does go public with a ~$1 trillion valuation, this would be among the largest IPOs in history.

-

It signals how serious the company is about scaling massively (in compute, infrastructure, model development, enterprise adoption) and potentially needing huge capital injections. For example, CEO Sam Altman recently talked about building ~30 gigawatts of compute capacity. Reuters

-

It offers investors a chance to “own” part of what many see as one of the most influential AI companies.

-

It also may impact how competitors, regulators, and infrastructure suppliers act — since the IPO would mark a maturation of the generative-AI business.

⚠️ What to watch & caveats

-

These are early stage discussions. The timing, valuation, amount raised, and structure are all subject to change depending on market conditions, company performance, regulatory/regional issues. The Reuters report emphasizes that plans “could change”. Reuters+1

-

A ~$1 trillion valuation is ambitious. It implies not only strong current metrics, but also very high expected growth and/or strategic value. There’s risk if growth slows or competitors erode the moat.

-

IPOs in the tech/AI space carry extra layers of complexity: hardware/infrastructure capital intensity, regulatory concerns (especially around AI safety), the need to shift from private to public-company governance, etc.

-

For investors, buying in pre-IPO or IPO implies evaluating many unknowns: future profitability, business model robustness, regulatory exposure, how the compute cost curve evolves, etc.

20251030 Trading at 660x earnings? No problem. $PLTR

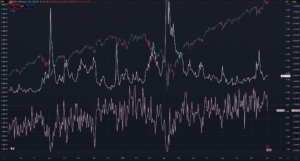

20251029 Powell Speech

🧩 What actually happened

-

The Fed cut rates by 25 bps (to 3.75–4.00%) — the first cut of the cycle — which markets had partly priced in.

-

However, Powell’s tone was not dovish enough for traders expecting a clear rate-cut cycle.

-

His remarks that “December is not locked in” and that the Fed remains “data-dependent” and “not on a preset path” signaled uncertainty rather than a commitment to continued easing.

📉 Why the S&P 500 fell sharply at that moment

-

Disappointment vs expectations

-

Markets expected not just a 25 bps cut, but also a strong signal of further easing.

-

Powell instead implied caution, saying inflation remains above target → investors interpreted this as “the Fed might pause again.”

-

-

“Bad news is bad news” tone

-

The Fed cut because the economy is weakening (labour market softening, unemployment rising).

-

That’s not “stimulus” optimism — it’s concern about slowing growth. Equities dislike that implication.

-

-

Algorithmic reaction

-

Once Powell’s phrasing hit the wires (news algos scrape key terms like “not on preset path” / “data-dependent”), automated trading systems likely dumped equities, pushing the S&P lower in seconds.

-

The timing — roughly 11:30 AM ET — matches when Powell’s press Q&A or prepared remarks were disseminated through Bloomberg and Reuters terminals.

-

-

Bond market re-pricing

-

Yields may have snapped higher after the “no preset path” comment — because that reduces expectations for future cuts.

-

Higher yields → lower equity valuations → instant sell-off.

-

📊 Market interpretation summary

| Signal | Market Read | Impact |

|---|---|---|

| 25 bps cut ✅ | expected / priced in | neutral |

| “Not on preset path” ⚠️ | no promise of more cuts | negative |

| Inflation still above target ⚠️ | implies caution | negative |

| Labour market weakening 😬 | risk of slowdown | negative for earnings |

| “Balanced risks” 😐 | not a pivot to full easing | mixed |

→ Net result: short-term disappointment → sell-off.

🧠 Big picture takeaway

This is a classic “buy the rumor, sell the news” moment:

-

Markets rallied into the Fed cut, pricing in a full easing cycle.

-

When Powell didn’t fully commit, traders locked in profits.

-

Now, focus shifts to upcoming inflation and jobs data — each release can swing markets sharply because the Fed made policy explicitly data-dependent.